Capitalism: The Individual At The Center Of The State with G. Edward Griffin

Podcast: Play in new window | Download

We all have different social and political stands. This normally starts when we’re young and honed by various exposures to different environments. Writer and a documentary film producer, G. Edward Griffin followed his curiosity about these ideological discussions in the ‘60s and found himself attending a communist group. However, the things that he discovered upon reading all these communist books opened his mind to more questions waiting to be answered. His worldview has grown all through the years of studying and research, and he realized that the struggle is being able to simplify the concept of whether the basis of the society is the individual or the mob. He shares sensible insights about individualism and takes us through a deeper understanding of capitalism and all of the powerful and reasonable stands on the real balance of having the individual at the center of the state.

—

Watch the episode here:

Listen to the podcast here:

Capitalism: The Individual At The Center Of The State with G. Edward Griffin

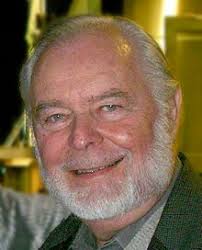

We have a very special guest and his name may be familiar to most of you, his name is G. Edward Griffin. He is a writer and a documentary film producer with many successful titles such as The Creature from Jekyll Island, The Capitalist Conspiracy and World Without Cancer. He is listed in Who’s Who in America. He is well-known because of his talent for researching difficult topics and presenting them in clear terms that all can understand. Ed, it’s a pleasure and an honor to have you on the show, welcome.

Thank you very much. It’s a pleasure to be back.

Over the years, I’ve had some very enlightening conversations with you. It includes some of the presentations you’ve given at different events. I’m fascinated by how articulate you are and how well researched you are, but also how you present yourself and present these topics, which I believe goes to your character. Maybe before we get into the topic now, which is capitalism, how would you describe your philosophy about life?

I thought we were going to narrow it a bit about life, but that’s interesting. That’s like my favorite speech topic is the world and everything in it. My philosophy about life, maybe we can do that again sometime, but about the social and political aspect of our lives, it’s considerably a narrower field. It’s taken me a lifetime to refine my concepts on that. Now, they’re so clear to me. It’s so obvious. I think to myself, I must have been a blithering idiot most of my life not to have seen it because now that I do see it, it’s like night and day. The old saying is that once you see something, you can never forget it. Sometimes people do, but in terms of a worldview, you never forget that. Once the bell is rung, it can never be un-rung. Once you know, you can never not know.

This is all prefatory to this because I have a great deal of optimism about the world now in spite of all of the negative and horrific things that are going on. I see a great awakening going on. Young people, in particular, are coming to know and they are seeing the truth. They’re hearing the bell being rung. Even though all this turmoil I still going on, I’m aware of this growing groundswell of awareness of young people. They’re going to be here long after I’m gone and they’ve got it. Like you, you’ve got it. I know you have. Once you understand that, you never don’t understand it. Back to the question, what is my view? Like a word or a handle to describe who are you? Are you a conservative? Are you a liberal? Are you a left winger or a right winger? Are you a moderate? What are you? A neocon or whatever, all these words are floating around. A capitalist, a socialist, a Nazi, a fascist, all of these things. I was in that trap for most of my life trying to figure out which one did I want to be.

I picked one that sounded pretty good, then I got to learn a little bit more about it. I said, “Nope, that’s not me after all.” I went through the whole thing. I think every young person starts off being some communist, a socialist, a collectivist is the word. It has so much public relations appeal. The greater good or the greater number. Isn’t that wonderful? We all have to get together and be a team player. These things are very appealing and they’re good in so far as you go, but nobody ever looks at the flip side of the coin. It’s not what you do so much or what you want to accomplish so much. It’s how you do these things and how you accomplish them. I learned that a long time ago because, in the ‘60s, I was very curious about all this ideological discussion. I went down and I said, “I’m going to go down to the communist’s bookstore. I heard there was one in town,” and I did. It was down in Larchmont Street in Los Angeles, practically in downtown. There it’s called the People’s Bookshop. I went in there and I got to know the comrades pretty well.

They thought I was a convert or potential convert. They invited me to their study clubs. Their study meetings, which I knew and everybody knew that this was a recruiting funnel to get me into the party. I played along with it. I didn’t know much about it and I’m here to learn. I told them, “I don’t know what you guys are up to but I’d like to know. Show me what you believe, what are your books and so forth.” I don’t think they expected what happened because I bought their books and I read their books. I not only bought them, but I read them. It wasn’t long after going to a couple of those so-called study groups, I realized that I knew more about the doctrine than they did because they hadn’t read. They had slogans. I’m leading to this. I realized in that early stage that most people are driven by slogans and certainly those on the left and the right too, they’re driven by slogans.

One of the greatest slogans and it’s very appealing for the communist and socialist movement is, “From each according to his ability and to each according to their need.” What is wrong with that? Isn’t that wonderful? Isn’t that the basis of charity? Isn’t that the basis of all the religions of the world? To help your fellow man in need to the best of your ability. Naturally, it’s appealing but what they don’t tell you is how. You have to think a little bit. Not take this to the next step. How? It’s the argument for world government would bring peace because there would be no nations to fight each other. If there could be no nation, there could be no wars between nations and so forth. Then you’ve got to ask the question, “What kind of world government?” As a kid, you don’t think of these questions. When I was trying to figure out what all this mess is, I suddenly realized that in the Western world, there were only two basic ideologies. If you go outside of the Western world, you’ve got theocracy for example.

The government based on the concept that the leaders are representatives of God. They’ve been empowered by God. In fact, they have some kind of spiritual status that makes them above human. There are many places in the world now that still believe that. In centuries past, it was much more common than it is now. That’s not the driving philosophy in the Western world. Theocracy is not our problem. Our problem is something else. In the Western world, there are only two concepts and they have words. These words were well-known 80 or 100 years ago. I found out in the literature that these words were used to all the time, but I never heard them when I went to school. The words are collectivism on the one side and individualism on the other side. What is that all about? When you take these other words like socialism, communism, fascism, leftist, rightist, moderate and all these things. You peel off the labels of those concepts and all of them are variant of collectivism.

They’re all the same if you understand what the underlying elements of the ideology are. I made a study of that and I came up with about eight. They were quite common such as I mentioned the origin of the idea of what is the ultimate goal. The conflict between the individual or the state or the collective, which is more important. The collectivists, whether they call themselves communist, socialist, fascist, Nazi, whatever, they all believe that the group is more important than the individual. That the individual must be sacrificed if necessary for the greater good of the greater number. That’s that magic phrase and I bought into that when I was in school. I know that sounds good. The greater good for the greater numbers.

It’s a mathematical equation. If you’ve got three over here and they want something and only two are here, well the three get it because it’s the greater good of the greater number. The old cartoon about democracy. The greater good for the greater number. The cartoon shows the wolf and the bear arguing over what’s for lunch and the lamb has only got one vote. The democratic thing is that the lamb has to go. My worldview gradually has grown over all these years of studying this and making a lot of discoveries and frankly finding out how ignorant I was. Even to this day, I don’t think I have any idea that’s completely original with me. Everything I have learned was known by the ancient. It was known by people hundreds of years ago and they wrote about it. I just never read their stuff.

Now that I’ve found some of these things in the old documents and I found books that had been forgotten. Some of them had been buried and deliberately hidden from view. I realized that these ideas are not new but they’re very important. I realized that the struggle is between this concept of what is the basis of society, is it the individual or is it the mob? Once you get it simplified down to that concept, it begins to get easier to straighten out. What is my view? I am what you would call an individualist. I believe that the individual is all there is in human society and hence, the most important thing. I don’t believe that you can vote away a human right.

A human right is yours. If you’re an individualist, you believe this. That you’re born with certain inalienable rights as they said in the Declaration of Independence here in America. Inalienable rights, which means they’re individual rights, they are not group rights. I don’t care how many people there are out there, there’s a mob out there and they don’t like it. Maybe they don’t like your beliefs. Maybe they don’t like the color of your skin. Maybe they don’t like your religion. Maybe they don’t like the way you talk or whatever it is, they don’t like you. As if they can gang up on you and there are three of them and you’re only one or two. In the concept of collectivism, the three or the larger number gets everything. There’s no question of limitations and the power of the group.

Once you get down to that understanding, things began to fall into place. I believe that the structure of society is based on individual rights and that we have them. They come with this. Some people would say that they’re God-given. That makes you nervous, then they’ll say, “Anyway, you were born with them.” They’re hardware, they’re not software. You have these rights and you create the governments. The people create the governments. The governments can do only those things which you as an individual have a right to do because that’s all you can delegate to the government. It’s what you have the power to do. Once you get that concept in place, that’s the next one and they go, “That’s an interesting thought. What can I do against my neighbor and using force and violence against my neighbor? What’s okay for me to do to kill my neighbor? Is it ever okay to kill my neighbor or somebody I never saw before?” The impulse is never okay, but that’s not right. You do have the right to self-defense.

Capitalism: It’s not what you do so much or what you want to accomplish so much. It’s how you do these things and how you accomplish them.

If somebody is trying to kill you, “Lord, help us,” but it’s desperate if you are the lamb. You didn’t pick the fight. They’re trying to take your life. They’re trying to kill you. Maybe they want what you have. Maybe they just don’t like you. They’re trying to kill you. I don’t think anybody would blame someone for defending their life, their liberty or their property with violence if they had to into the defensive mode. If that’s the only basis for individuals to use violence against another human being, then that is the only basis that this individual can delegate to his state, his authorities, to the police, the military, the judges, the courts and all that.

If they derive their power from the people, as we’d like to say, then that’s all that they can do because that’s all we can give them to do. Once you get that in your mind, you mean the state can only use force, meaning military force, guns and jails. They can kill you in the electric chair. They can punish you and they could torture you and all these things. The only thing they can use any of that for is in the defense of life, liberty and property. That means that 99% of the stuff that our state is doing that supposedly for the greater good of the greater number, they’re doing it without any basis at all. They’re just doing it. They don’t have a right to do it because you and I don’t have a right to tell our neighbor that he can’t sell his candy bars on Sunday. We can’t do that. We can’t tell our neighbor what to teach his kids. We can’t tell our neighbor how many hours a week he must work or whether or not he needs a lunch break and the list goes on and on. We cannot take money from our neighbor that’s got a lot of money and give it to the other neighbor that doesn’t have a lot of money because we want to justify it.

I’m glad you’re hitting on all of this because is it possible to understand the proper role of government? Can you understand what a free market is or anything? Like you’re saying, there are these layers that come on top of this initial idea of individualism versus collectivism. The collectivism idea is an abstract, individuals are all that exists. If you can’t get beyond that, then there’s no sense in getting to the next layers as far as the Second Amendment, as far as other laws, other ideas and other structures. Would you agree with that?

Absolutely. As much as I revere the constitution with the United States, I think it was an inspired document. It’s the best political document that’s ever been written. I also know it was a beta model. It was the first time in history that any men had tried to create a state based on the concept that we’re talking about, limitations on the power of the majority or in the power of the ruling elite. Nobody had ever tried that before. We just assume that if you had control of the guns, that’s it. You’re in charge. You better like me because if you don’t, these are not going to go well for you. I have a great revere for the constitution because it was a beta model to try and instill some of the concepts I’m describing onto an agreement on a printed page. This is what we agreed to.

I also recognize that it wasn’t perfect. I also recognize that if we’re going to be talking about these principles and advocating them on a global basis and we go to some country in Europe or in Asia or in Africa and we say, “The US constitution says,” they look at you like who cares what the US constitution says? I realized quickly that we want to be missionaries on this concept. We had to talk about the principles. Even if they had never been embodied in the constitution, which was almost a fortuitous accident maybe. Even if it had never been written, these principles still needed to be understood and talked about. You’re absolutely right, I think it’s the principles that we have to look at.

It’s interesting if you go back and look at whether it’s John Locke or some of his contemporaries and then the Scottish enlightenment. How all of these very similar ideas, which originated before their time. As they started to converge and even though there weren’t the modern ways in which you communicate, those ideas spread. They spread in parts of Europe and obviously in what’s now known as the United States. I think most people will embrace that fundamental idea. That’s why I wanted to hit on that because if you can’t get your mind around that, then there’s no sense in having a discussion about the ideas that come afterwards.

Let’s go there. Let’s assume that our audience understands that we have inalienable rights, fundamental right and the purpose of our current government structured in the Declaration of Independence then leading into the constitution was to protect these rights. That was the function and proper role of government. Going to the next layer, why is there this draw towards what we currently have now as a very collectivist society? There is this moral backbone it seems into most of these collections of people, collections of individuals. They’re driven by this moral justification and you’re right, it doesn’t matter if it’s Democrats or Republican, there are these groups that have a very similar initiative. How have you come to understand this draw or this positive thing that has come from the collective grouping doing and acting for the benefit of the whole, if that makes sense?

Once the bell is rung, it can never be un-rung. Once you know, you can never not know. Click To TweetIt makes a lot of sense and I think that the answer is twofold. It’s a combination of the fact that people do not know or have not taken the time to think and study about the questions that were raising the issues. It’s like they’ve never been to school. They don’t know how to read and write. They don’t know what math is all about. They’re not informed. It’s not that they’re stupid, that’s not it at all. It’s that they’ve never been exposed to this information. I’d like to use the word politically illiterate and it’s not their fault because they’re depending on the school system and the society in which they’re born to deliver this information. At the turn of the last century, that information was being delivered at an increasingly higher level in America. The school systems were doing increasingly a good job I thought.

Then with the advent of the rise of collectivism and the takeover of the educational system by the missionaries or collectivism and they started to rewrite the textbooks. Then you’ve got the large influx of money from the Rockefeller Foundations and the Carnegie Groups and so forth. They stated right in their own literature that their goal was to change the attitude of the people in America, their favorite collectivism. They said that openly. That’s what they set out to do and they did it. They did it through, first of all, removing the information from the history books and from school systems that you need in order to come back the propaganda. They’ve been so successful that now you can hardly find any remnants of this history in our educational system.

Unfortunately, the young people going through the school system are denied this background history. That’s half of it. The other half is that there is a class of people who know exactly what they’re doing and they’re the ones responsible for the extraction of this information. For the substitution of a new philosophy or a new point of view, it’s their favorite collectivism. They profit immensely in this situation. Over the years, I’ve never known what to call these people. People call it the elites and the powers that be and all these names. I finally came up with this, I call it now the PP class. What is the PP class? The PP class is those people that are made up of the predators and the parasites. In every cross section of any society, any place in the world, any race, anywhere throughout any period of time, you’ll find that a certain percentage and I’m going to say about 15% or 12% of the population that are predators. Probably another 15% on top of that would tend to be parasites if they were encouraged. If they were given a free ride, that side of their nature would come forth.

Here you have the predators who want to control you. They want to control society for their own wealth and power and they really are predators. They had no sympathy or compassion for the human being at all except to make them their servants and their machines to serve them. They will deceive you and deliberately lie. They’ll even kill you if you get in their way. They’re just predators. Then you’ve got the parasites that get sucked into this thing and they get dependent on the predators. They’ll do what the predators say. They’ve got a pretty good little army there that will work day and night to continue to further their nest at the expense of your work and your liberties. It’s as simple as that and you could go sub-analyze that into different subcategories. Overall, those are the two main forces that we’re facing.

Let’s pivot to this because the theme of our season is capitalism. The discussion we’ve been having and what we’ve been referring to as far as principles and individualism and capitalism. What’s the connection in your mind?

The word capitalism, that’s one of those words that is very hard for people to find in agreement on the definition. If you’re a collectivist, then you’re thinking maybe you’re not one of the PP’s out there, but a student hearing all about this will think, “The greater good for the greater number,” and all of that and so you’re into that. Then somebody says, “These capitalists are all selfish individuals. All they care about is getting to be rich and they’ll just grind you into the ground.” Are you going to be a capitalist? No, that’s the definition of capitalism. It depends on how you define the word capitalism. You get 50 people in the room and ask them to define capitalism, I bet you’ll have at least 35 or 40 definitions.

What’s my definition of capitalist? I like to go to the roots of the word. Capital is a form of property. Capital is property. A capitalist is a person who believes in the concept of privately-owned property and he uses that property for whatever purpose he wants. In an industrial society, the capital, this property becomes a means of production. He invests his personal property into machines, into educational institutions and training programs. He may even have schools they create to bring people to a higher enough educational level so they could work within his factories or his systems. For them to provide jobs and raise their standard of living. He can be a criminal or he can be a bad guy and use his capital for purposes in which we would not object. That’s up to him. If he’s going to use this capital against the laws of the land, then he’s a criminal. He’s a criminal capitalist.

Capitalism: We cannot take money from our neighbor that’s got a lot of money and give it to the other neighbor that doesn’t have a lot of money because we want to justify it.

Being a capitalist doesn’t make you a good person, except it does narrow your focus to the fact that you believe in private property. That is I believe the foundation not only for prosperity but for personal liberty. If you do not have private property, you cannot sustain yourself. You cannot be independent. You have to be dependent on the group. What’s the group? It’s always the state. You become the servant of the state. You do what the state tells you to do if you do not have private property, which is why people like Karl Marx, Lenin, Hitler, Mao Zedong and all the other great collectivists of the world said, “Private property has got to go.” They teach that in the schools now. They say private property has got to go because it’s not right. It’s not fair. They put a twist on it and they sell it as a humanitarian objective when they know that private property stands in the way of the individual being subjected by the state. My definition of a capitalist is it’s simply a person who believes in private property.

I spent an entire year of going through John Locke’s ideas around life, liberty and property and what those things meant and how a very successful society has to understand those principles and how they work together. I look at what you said, which is brilliant, that property or capital is something tangible. It’s the physical world but I haven’t look into these days with the internet and how much is being done there, which is hard to distinguish is that physical or nonphysical? In the end, human beings, the brilliance we have in each of us is that we’re all different. There’s a uniqueness about human beings that’s incredible because we’re all different. We all have different backgrounds. We all think a little bit differently. We all have different ideas. That’s why I think property is an extension of that. Property in and of itself, I don’t know if it has value. The value comes from our ideas and our uniqueness and how it applies to that specific physical resource and what can be done with that.

If it has no value, it’s not property because nobody wants it. If it’s a rock in the middle of the stream and it has some value but not very much. Nobody cared for it unless it’s pretty. If it’s pretty then it has value and somebody wants it, now it’s property.

It either has to be like a relationship between individuals in order for property to have that value. It’s a fascinating idea but at the same time going back to your point of criminal capitalists because there are. The criminal capitalists are those that prey on the individuals but also they violate those inalienable rights. I look at the structure of free market capitalism and how it reinforces and protects individualism and it allows for both the success and also the failure associated with using capital. Tying into the idea of individualism, you have to protect a person’s desire to want to use property to do something and to benefit themselves. Ultimately, it has to benefit someone else in order for it to be determined as property.

The principle of enlightened self-interest is extremely important. Even if you’re a son of a gun and you’re a bastard but if you realized that the only way you can gain wealth and comfort is to build something or do something that serves a purpose in the society, then you’re going to be a constructive human being, whether you like it or not. This is your enlightened self-interest to do it.

If you look at the whole centralized power around what capital is and resource is, it conflicts with the ideas of individualism. I look at the word that’s thrown out there now which is equality where this person has too much money or this person has an unfair advantage. How have you come to understand the drive for equality and what that even means because that’s a word that is defined in a number of ways?

First of all, it’s a word that is very difficult and people have different responses to it. As you said so well that no one is the same to somebody else, exactly the same. Nobody is exactly equal. Thank God for that. Wouldn’t it be boring if everybody was exactly like we are? We’ll be mad at each other most of the time because we’re onto each other. We know all of each other’s tricks and all of that. Thank God there are differences in talent, structure, strength, intelligence, aptitudes and I might even say gender. Nobody wants to be equal in the sense of that context. What we want to be equal and under what circumstances is under the law. We wanted to be treated under the law equally and that’s all we can ask for, all we should ask for. We don’t want any favoritism. We don’t want to be treated as a special group or class.

A capitalist is simply a person who believes in private property. Click To TweetEven if our parents were destitute, even if we were poor or if we were denied something, it didn’t have love or something, maybe one of our parents is dead and all of these things. Maybe we were born with a deformation of some kind and maybe we don’t have a hand. Maybe we were in an accident and all these things. All we have to say is that you cannot give any group any favorite treatment under the law, no matter how worthy their cause is or how compassionate you may feel toward them. Once you crossed that line, there is no stopping that. You can always make an argument, if this was true for Matilda, it’s also true for Johnny. His condition is a little bit different. Now you got two exceptions. If it’s true for Matilda and Johnny, it’s also true for Mary. The next thing you know, the whole world has got these exceptions.

All you need to see that is go look at the federal income tax and see all the exemptions and so forth. It just becomes a maze. It’s illogical. It’s unethical. For all we can ask for is to be treated absolutely equally under the law. Most people will say, “That sounds good.” Yet they’re perfectly content with the existing legal system, which I guarantee you 90% of the existing laws on the books do not treat people equally. 90% of them at least are designed to shift favoritism from this group to that group. Give this person a little edge over that edge or to punish this group for that. 90% of the laws are not administered equally and we’ve got to do something about that if we want to create a better world.

It’s one of those things where it’s going to continue to have corrections of the law to compensate for the deficiency that is created by another law. Then it’s this vicious cycle of trying to compensate for something that’s simple.

The truth of the matter is that it’s not just stupidity. It sounds good but they’d made a mistake. They didn’t think it through because it won’t work. What we don’t realize is we’re dealing with predators. They did think it through. They know exactly that it won’t work, but in the process, they know that it puts them in the middle. They are now the administrators of the system. They’re in charge. It helps them a lot. They don’t care whether it doesn’t work. In fact, they’re delighted that it doesn’t work because now it’s an excuse to go back and have another program and more taxes, more regulations and more power to them. It’s not stupidity. We got to remember there is a predator class at work.

I had the thought I had on bullet points to talk about monetary policy. I think a book that is definitely something that you created as this enlightening document to be able to understand what the monetary system of the US is or just a central monetary system in general. Going into that will take another take another few hours. I look at even with that, which is another way of describing collectivism and also the creation of equality in a sense. If you don’t understand the simple principles of what individualism is and also the principles associated with why our founding fathers created the documents that they did and why they did it.

Escaping from the political systems that they were in before, then there’s no sense in getting into monetary policies because it will just be super confusing. At the same time, you look at what is running the world right now, it’s commerce to an extent. Commerce is all controlled. It comes down to the control of a central bank and how they’re able to manipulate certain things, for the interest of some. I won’t even get into what those groups are, but you know where I’m going. Did a lot of what we’re talking about play into the desire that you had to write that book?

I have to think back. I’m rewinding the tape now all the way back many years. I think the honest answer is no, because when I had a desire to write that book, frankly I had no idea what I was getting into. Had I known, I’m sure I wouldn’t have attempted it. It was too much but ignorant though I was, I thought, “This is an interesting thing. How money comes into creation. How they create money out of debt, out of nothing.” Actually, debt is even worse than nothing. I thought, “I’m going to do a little documentary on this one.” That was just the beginning of my learning process. Had I known them, I wouldn’t have gone all the way through. It’s too much. The depth of this problem is something that grew in my awareness as I prepared for writing the book. It was a learning process.

Capitalism: Young people that are recruited into the left movement are definitely crusaders. They think they’re working for something good.

Looking at where we’re at now. You had said something that hit home, which is there’s optimism. Despite what’s going on in the world around us, which is quite a bit. Where do you derive the energy for that optimism? What are you seeing that makes you optimistic?

That’s a two-part thing. The first part and is the most interesting is where do I derive that energy? Where does that drive come from? I had to stop and think about that. Since we’re talking about the predator class, we might think that at the other end of the spectrum there is a crusader class. I think that’s true. We have about the same percentage or 3%, 10% little group. At the other end, that are born with that drive to shut things right. I’ve discovered late in my life. I was an adult, I was married, I had a job and had a family and everything before my crusader gene kicked in. I had no interest in saving the world or anything like that. My interest was climbing the ladder of success, looking good, living well and all that sort of thing. When I got into some of these issues that we’re talking about now, I realized, “What am I going to do about it?” That’s a problem. Some of us have this insane desire, this insane thought that we can do something about it and we must do that.

The honest boldfaced answer is that I can’t help myself and I have a feeling you’re probably the same way. Probably at this end of the spectrum, there may be 5%, 6%, 7%, 10% of the people who just can’t help themselves. They’d got to rush forward and see what they can do to correct the wrongs. No matter what it takes, we can’t sleep until we figured it out. That’s my drive. I’m not claiming any great honor for it or any praise. It’s the way I am. My crusader gene is always buzzing. That’s interesting because if you look at the world in retrospect, in all history, all the great changes in history were done by 1%, 2% of the population. That’s all.

It’s been 1% or 2% in one end, 1% or 2% on the other end fighting it out and the other 98% were sitting back saying, “I don’t know which side will win but whichever side wins, I was always on that side.” It’s sad in a way, but it’s encouraging too because it means that we don’t have to convince our neighbor next door cutting his lawn. If he looks at us with that glazed look and he says, “Huh?” “What did you think about the Super Bowl?” That’s what he probably wants to talk about. “What about that Dancing with the Stars last night, wasn’t that something?” If that’s the focus of his life or her life, then you just say, “Next.” We’re looking for that 2%, 1% that have this crusader gene.

That’s an amazing way to put the crusader gene. I’ve never heard of that, but that makes sense. I look at a lot of what drives other collectivist groups. They probably think that they’re crusaders too.

A lot of people, especially the young people that are recruited into the left movement are definitely crusaders. They think they’re working for something good. I was that way at first, then I realized the trickery involved in all of these slogans and then that changed everything.

Maybe we’re going to end with this, how I’ve looked at things over the last couple of years and wanting to understand how important it is to recognize not just the principles associated with individualism, but you yourself. That there’s beauty in all individuals. There’s that uniqueness of where they’re born, that the socioeconomic environment, that political environment. People are driven in very similar ways. What touched me over the last couple of years is understanding more about the hierarchy of what people are driven to do. Maslow has one model. I think it’s pretty simple to understand. We don’t have to worry about in our day and age, food, shelter and clothing. Those are somewhat simple to come by. Then as far as inching our way up the ladder, people are getting very close to this idea of wanting to do purposeful things.

Debt is even worse than nothing. Click To TweetThat’s where it comes down to the collectivist idea, where it does have, in a sense, a moral foundation. They think they have a moral foundation and they’re pursuing something for the best interest of others. I look at most of those groups and really what it does is it ruins the individuals. Whether it’s giving away welfare and their social programs and giving away this and giving away this, redistributing wealth. It ruins the experience of the individual to grow and to experience life. That’s where I find it very unnerving because I look at how important the experiences I’ve had in life, the difficult experiences. If I had been bailed out, where I would be and not having learned from those lessons. I look at family members, I look at so many different circumstances where individuals are robbed of experiencing life. I think that’s one of the travesties of our day.

You’re certainly right on target with that; the idea of protecting people against the effects of their own folly. I think it was Lord Acton or somebody like that said, “If you protect men from the effects of their own folly, you will fill the world with fools,” and that’s exactly what happens. You realized that if you follow the mantra of collectivism, you do not help people, you actually hurt them. You may give them a temporary meal. You may give them something they need very badly at the moment. That’s charity. I’m all for that. You should be doing that but to build a system around that so that it becomes no longer voluntary, but you have to do it or you’d go to jail.

Now, you’ve created a system, a machine that’s going to destroy the average person. They will not help them at all. I came to the conclusion that the mantra of collectivism is for the greater good of the greater number and if necessary, that means you have to sacrifice the individual. I finally came out the other side realizing that the individual should be the center of the state, protecting the individual. That is the greater good of the greater number. That does help the greater number to a higher degree than collectivism, which professes to have that goal but accomplishes just the opposite.

How can individuals follow you and learn more about what you’re doing? I know you still write quite a bit and contribute in different areas. What are some of the best ways to keep up to speed with what you’re up to?

Thank you for that. Supposedly the first thing I should do and I always forget this, is to talk about our commercial site, RealityZone.com. That’s where we have a lot of books and recordings, videos and audio tapes on the themes that we’re talking about here. My books are there too but we have about a hundred different excellent items. It’s a good place to start if you’re looking to flush out these ideas and say, “I wonder if this is true,” and you want to dig into the history, the rationale and the logic of it all. Then you have to do a little study. That’s the starting point. You have to put these ideas into action. Knowing that something is a superior idea, doesn’t make it win, especially when you’re up against the PP class. The predators and the parasites are working against you and all of them are looking for laws, the force of the state to compel you to shut up or go away or conform to their point of view, whether you like it or not.

To have this knowledge and a big bookcase full of books and you read them all, “You can’t do anything to me. I understand. No, that’s not it.” You’ve got to get out there and get active and recapture the system and change law if necessary. I’m devoting my attention to that aspect now. For anybody that’s interested in that, I’d like to invite you to come visit us at FreedomForceInternational.org. It’s an organization. It will tell you all about it there on the website. It’s a group of people. We now have members in 85 countries. It’s amazing. This issue of collectivism versus individualism is global, ladies and gentlemen. It’s not just here in the United States. That gets even further advanced in some other parts of the world. It’s more sophisticated here but it’s quite global, let’s put it that way. Then let’s go right to the chase. In order to get the word out to as many people as possible, we’d devise some marketing tactics if you wish to call them that.

We’ve adopted the idea of the Red Pill because you can talk about ideology all you want, collectivism and individualism. Some people will say, “That’s hurting my brain.” If you talk about something more popular like, “Take the Red Pill and break out of the illusion, face the reality.” “I saw the movie, The Matrix. It was a pretty good movie.” All of a sudden, it’s in a more popular frame and not quite so intimidating. We’re having fun now talking about these things in the context of the Red Pill. It’s fun, so I’m getting to the point now. We have a Red Pill Expo. It’s the third one that we put on and it’s scheduled for June. It’s coming up June 2019 in Hartford, Connecticut. Put it on your calendar, please. It’s on June 7, 8 and 9 and if you want to know more about it, come to the website which is RedPillExpo.org and you’ll learn all about it.

Capitalism: The mantra of collectivism is for the greater good of the greater number, and if necessary, that means you have to sacrifice the individual.

It’s a great event. That’s all I can say. It’s a no holds barred event. People come there. We don’t agree with everybody that’s on there. In fact, we have some pretty good debates sometimes. The idea is if you want to break out of the matrix, out of the illusion, you have to open your mind to the fact that maybe what I know or think I know is not true. If you say, “I’m not going to listen to that person because that’s not true.” That means that you already have closed your mind to ever getting outside of the box that you’re in. If everything out there is not true, only what’s inside my box is true and you’ve had it. You’re getting into some great discussions at the Red Pill Expo. I invite you all to come.

I’m from Hartford. Where are you doing it in Hartford?

I should have the name of the conference center, but it’s a big one. Right in the middle of town. I’ll have to look it up. Come to the website and you’ll find out.

We’ll post everything. I was just curious personally.

It’s going to be a lot of fun. I got to tell you, we just finished the website and the enrollment process. The man who’s taking care of our Facebook and social media stuff sent that tweet out to a couple of people and several minutes later, we had our first enrollment. It’s a good omen. I know people are going to flood to this thing. It’s something you don’t want to miss.

This has been a fascinating discussion and I know you’re passionate about this. You keep doing interviews and you keep doing videos and it’s a worthy cause because, in our day and age, people are understanding more and more. At least they’re curious and more open-minded. Hopefully, these ideas resonate so that people can start to celebrate what can ultimately change their lives but I think change the world.

These ideas do resonate. That’s the fact. They resonate because they’re the truth. When you hear it, the bell is rung and you think, “I’ve been waiting for that sound all my life.” There it is.

The biggest barrier of the truth is that you may have to be wrong and people don’t like being wrong.

It’s embarrassing but at the end you think, “Now, I’m awake.”

Anything that’s really changed the world is somebody had to step back and question assumptions. Ed, it’s a pleasure as always. Good luck with everything and I’m sure we’ll get back in contact. Maybe we will do a version two about the Federal Reserve.

We’ll do version two, meanwhile, put it on your calendar. I’ll see you in Hartford.

Thanks, Ed.

Important Links:

- The Creature from Jekyll Island

- The Capitalist Conspiracy

- World Without Cancer

- FreedomForceInternational.org

- RedPillExpo.org

- www.RealityZone.com

- www.FreedomForceInternational.org

- www.RedPillExpo.com

- https://RedPillUniversity.org/person/g-edward-griffin/

- https://www.Amazon.com/G.-Edward-Griffin/e/B001KMN0ZE

About G. Edward Griffin

G. Edward Griffin is a writer, documentary film producer, and Founder of Freedom Force International. Listed in Who’s Who in America, he is well known because of his talent for researching difficult topics and presenting them in clear terms that all can understand.

He has dealt with such diverse subjects as archaeology and ancient Earth history, the Federal Reserve System and international banking, terrorism, internal subversion, the history of taxation, U.S. foreign policy, the science and politics of cancer therapy, the Supreme Court, and the United Nations.

His better-known works include The Creature from Jekyll Island, World without Cancer, The Discovery of Noah’s Ark, Moles in High Places, The Open Gates of Troy, No Place to Hide, The Capitalist Conspiracy, More Deadly than War, The Grand Design, The Great Prison Break, and The Fearful Master.

Edward is a graduate of the University of Michigan where he majored in speech and communications. He is a recipient of the coveted Telly Award for excellence in television production, the creator of the Reality Zone Audio Archives, Publisher of Need to Know News, and is President of American Media, a publishing and video production company in Southern California.

He has served on the board of directors of The National Health Federation and The International Association of Cancer Victors and Friends and is Founder and President of The Cancer Cure Foundation. He is the founder of The Coalition for Visible Ballots, a grassroots organization for the elimination of vote fraud made possible by electronic voting systems. He is the Founder and Chairman of Freedom Force International.