Entrepreneurship: Taking Intelligent Risks with Francis Greenburger

Podcast: Play in new window | Download

Being an entrepreneur involves risk. Our guest, Francis Greenburger, has always been comfortable with it, not the “throw the dice and hope for the best” type but the type he calls intelligent risks. Francis is the Founder and guiding force behind Time Equities, Inc. and has earned a reputation for outstanding integrity and an uncanny ability to foresee changing directions and create value in a variety of real estate markets. Today, he joins us to talk about entrepreneurship, taking and controlling risks, and the characteristics that go into being a good entrepreneur.

—

Watch the episode here:

Listen to the podcast here:

Entrepreneurship: Taking Intelligent Risks with Francis Greenburger

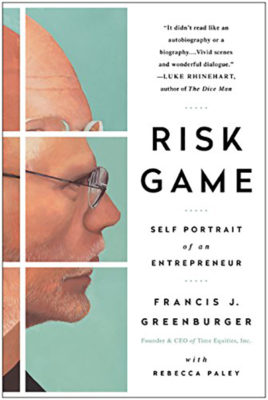

My guest is Francis Greenburger. He is the Chairman and CEO of Time Equities and the Owner of the literary agency, Sanford J. Greenburger Associates, which has represented noted authors such as Dan Brown, James Patterson, Nicholas Sparks and Nelson DeMille. He is also the Founder and Chairman of Art Omi, which was previously Omi International Arts Center and the Greenburger Center for Social and Criminal Justice. He’s also the bestselling author of Risk Game: Self-Portrait of An Entrepreneur. Francis, it’s such an honor to have you on. Thank you all for taking the time.

It’s my pleasure to be here, Patrick. Thank you.

Francis, I have a good question to start with. It’s around this topic and theme of entrepreneurship. You identify yourself in the subtitle of your book as an entrepreneur. What does that word mean to you?

I’ve thought about what the characteristics of an entrepreneur are. I would say one of the first characteristics are, did you have to be comfortable with risk? If you’re not comfortable with risk, you should use your talents in another context where you’re getting a steady paycheck or appropriate incentives. Being an entrepreneur involves risk. For some reason, I’ve always been comfortable with it. There’s what I call intelligent risk and then there’s throw the dice and hope for the best. I believe in intelligence risks which means if you’re very informed about what the challenges are, whatever it is that you’re undertaking and what the risk reward is, what is the opportunity? The reward, if you’re right, sufficiently reward you, given that there’s a chance that you might underperform your expectations or things might go wrong but you don’t expect. Those are some of the characteristics that go into a good entrepreneur.

The other thing that’s very important is to be creative because if you go out into the marketplace and you are trying to be a generic competitor, do what everybody else is doing in the same way, the only way that you can be effective there is on price. Mostly, entrepreneurs will not be successful at that because it requires quite a bit of scale. That’s a very hard way to succeed up against larger, more established players. The way the entrepreneur succeeds is by seeing things differently than other people or the other players in the market seeing a way out of the problem. Perhaps they can buy the asset of discount to what its stabilized value would be and find a way to bring solution to whatever the situation is or understand a market differently than other people. Tolerance of risk and creativity are two key ingredients.

It’s fascinating because it seems as if creativity and risk have a partnership if you will. Most people have a fear of risk, fear of something not happening the way that they presume, which is always the case. There’s a risk in everything. There are just different degrees. When risk presents itself, it seems like having the value and the understanding of creativity to navigate whatever challenge is thrown your way. Whatever obstacle exists almost allows you to have control over risk.

Don’t be intimidated by risks but see them as opportunities. Click To TweetIt’s funny you mentioned the fear of risk. My kids have one of those cups that has lettering on it. The expression said, “Imagine what you could accomplish if you weren’t afraid to fail,” which is another way of saying the same thing. What you’re saying is that creativity or understanding options and having ways to meet challenges is a way not to be intimidated by risks but see it as an opportunity.

What are some examples in your successful professional life where you have confronted risk and took it on and achieved success on the backend?

I would say the first thing is I look at markets differently than other people. Our real estate company not only invests nationally within thirteen states but we invest in five different countries within Europe. Years ago, I became aware that Holland was at the end of a very deep recession. A lot of real estate valuations have been hurt. The Dutch banks had stopped financing most commercial real estate at Holland, except if you had a ten-year lease with a credit tenant. In the center of Amsterdam, you could get financed. If you were in one of twenty suburban markets in Holland, you’re in trouble. Prices fell precipitously and occupancies fell. It was a very tough time. There were no local players who have the resources to step up.

We saw that opportunity and we began buying. In the beginning, we bought all the cash because we couldn’t get financing. It’s 3 or 4 years later, we own 40 office buildings and set up an office there. Fortunately for us, when we came in, it was in the later part of the cycle and things were covered, markets are doing very well and we’ve had outstanding results from our investment there. We’ve been able to entice a German bank to see things the way we saw them. In fact, we ended up getting very advantageous financing shortly after we acquired the sprockets. That’s an example of seeing things differently. In this case, bringing perspective that was outside of the Dutch perspective who was way down by their immediate experience by the conditions that they had to cope with.

Looking at that decision process means starting with the macro-economic approach where you saw economic depression. Toward the end of it, where did you see the opportunity that it would rebound? Was it in the company formation increases? Was it the technology that was coming out of Amsterdam? What were some of those micro things that you saw that led you to believe that investing in office space would be a good return on investment?

My approach was fewer data-driven or metric-driven than what you’re suggesting. The first thing I said to myself was Holland was one of the outstanding countries in Europe, always has been. They have a great deal of transparency which not all European do. They have very well-educated, very smart and in fact, quite entrepreneurial population. They have a lot of positives. To me, this was a place that I saw no reason why they shouldn’t be able to repair the cycle they were going to come back to have more normal or standard. The other thing is in the case with the properties that we bought, the first portfolio, we bought ten buildings and there were 70% occupied, but we were making about 9.5% return on the 70% occupants.

Taking Intelligent Risks: Tolerance of risk and creativity are two key ingredients of entrepreneurial success.

It was cash too not leverage, right?

Right, not leverage. My bet was a simple one. I didn’t think that things are going to get a lot worse than where we were or they might get a little worse but even if my return went from 9.5% to 8%, it wouldn’t be a tragedy. I felt whenever times got better, which I didn’t know whether that would be tomorrow or in a year or five years, I’m starting from a very high return base so I wasn’t worried. I felt I could weather any further erosion. I thought that we were a donator at that point. It was a pretty simple view. I thought we were entering at a good point. Things were profitable so we didn’t have to get better and we can still be happy, but my sense was this was a good place intuitively and was going to get better.

It’s the whole asymmetric risk analysis where you have tremendous upside but yet it’s not an equal amount of risks to the downside. It’s a limited amount of risk.

What happens is people often perceive that when you enter difficult times, that’s a risky thing to do. It’s the reverse. When you’re buying things inexpensively, things could get a little worse but they can also get a lot better. Whereas if you go in when things are very good, then you’re going to pay the top price. When you get to the top of the mountain, there’s only one way to go and that’s down. I’d rather start at the bottom.

There are so many sayings, when there’s blood in the streets is when you buy, even if it’s your own but usually it’s the opposite as far as the normal investor. The first time I went there, I had this appreciation of how entrepreneurial but also how driven and educated they were based on a lot of their history. They were the first engineers that figured out how to build a city that was underwater. That’s part of what makes up the future generation is technical and understanding. Parents have tremendous influence on the next generation and so forth. You had that generational work integrity behind what was going to be coming up in the future years to make a wise investment. That’s a great example of asymmetric risk ideas as well as looking at factors out there and seeing where there are opportunities.

It’s worked out very well for us.

Most problems can be solved. Sometimes you just have to be very imaginative and creative. Click To TweetI know you were in the publishing business. You took some tremendous risks there. Would you maybe tell us about some of those experiences?

We weren’t publishers, we were literary agents who represented writers and we sought publishers for their books. To some degree, what you’re investing in an author in the beginning is your time and your reputation. Economically beyond that, there isn’t a huge investment. If you’re not successful, you’ll have spent a lot of time working on something. You perhaps have tarnished your reputation if you put forth things either not worthwhile but you don’t have a great economic loss. When you’re an agent and you send a book to publishers, very often if they’re not interested, they go into long-winded explanations for why they’re not interested. In my view, frankly, I threw all those letters in the garbage because I don’t care if people didn’t agree with me. I was looking for a couple of people who did agree with me. There’s one publisher in the end. If 25 said no, it didn’t matter if the 26th said yes.

One of my first clients in the business was somebody who’s now famous but in those days was completely unknown, James Patterson. He sent me this manuscript. I hadn’t met him. He had read somewhere that I was a young age and looking at unsolicited manuscripts. I read this manuscript by him and I started sending it out to publishers. In fact, I sent it to 28 publishers. Every one of them rejected it. The 29th said if you rewrote it, they would consider publishing it. He did and they still rejected it. I then sent it to ten more publishers and by that time, I had run out of the publishers and I was sending it to different people at the same publishing house. Little Brown, they already rejected it. A lower-level editor there already rejected it but I sent it to a higher-level editor and he loved it.

He offered a generous advance for the first novel and went on to win an Edgar for best mystery of the year. His career was legendary. I only represented him for his first three books. That point he said to me, “I read about all your real estate transactions. I’ve got to figure out whether you’re an agent or you’re a in the real estate business.” I said, “I think I’ve done a pretty good job for you.” He said, “No, you’ve got to choose.” I said, “I’m going to be in the real estate business no matter what you say.” We parted company but he’s had an incredible career since then as we all know. That’s an example of having a point of view, feeling conviction with respect to it and then going and trying to get the market to agree with you.

It seems to me that you have a unique way in which you perceive opportunity. Taking the approach you did, putting your reputation on the line as you mentioned, going above and beyond and figuring out creative ways to reach different people at the publishing companies, it showed you that there was an understanding of what that opportunity was. You weren’t doing it to do it. You were doing it because you saw opportunity than most others didn’t see.

I have a conviction about my view of what he had written.

Taking Intelligent Risks: Every problem has a solution. The person who can find that solution is going to create value.

Did you have an affinity toward the mystery genre of writing before or did you read it and knew that there was some gold in there?

I can’t say that I was a mystery aficionado, I wasn’t. The name of the book was The Thomas Berryman Number and it was an assassination novel, espionage but murky. In those days, that would’ve been posting the JF Kennedy assassination, both John and Robert and Martin Luther King’s. Assassination was very much on people’s minds and it played into that and I thought it was well done. It was highly stylized in its language which differentiated it from a lot of other mysteries at the time. I believed in it.

What would you say is something that you see in entrepreneurs regarding the risk that they don’t see?

I work with a lot of people in my real estate company, a lot of very bright capable acquisition people who are in a sense entrepreneurs and often the process of underwriting real estate, take a view of it and then you’ve tried to figure out what you think is going to earn, projecting forward it over ten years. There are all kinds of assumptions that get into it. After a lot of experiences, they come to a set of assumptions and that’s what they present is their vision of that transaction. One of the things that I do is I push them and I say, “Let’s create sensitivities around some of the variables. What happens when you say the rents are going to be $18 and what happens if they’re $17 or $16? Do you think that the occupancy is going to be 92%? Show me what happens as occupancy slips down to 85%.” Creating all kinds of variances to the scenarios that people envisioned and to the assumptions that they put into any given situation is pushing beyond where a lot of entrepreneurs start out. They may be very sophisticated and experienced in reaching their view but then they don’t subject it to quantifying the what ifs. They talk about risks as a generality, but they don’t quantify and then look at the outcome. If X, Y, Z happens, that is at variance with their fluent view of the market.

Do you see the inability to do that as potentially creating a lot of risk in the marketplace right now?

Certainly, to the extent that when one is acquiring assets or competes against people who may be less knowledgeable, it’s important not to follow the market because it’s the market. You have to have a very clear view of what you’re going to do with the asset, how are you going to run it and how are you going to manage it? You have to be very disciplined in that because there are always competitors in the market who may be less informed or they may have other sources of capital. Sometimes if there’s a fund out there who has a use it or lose it situation, maybe they’ve raised $50 million and $100 million invested over two years, you have to return the money to the investors. As they get towards the end of their cycle, if they haven’t been able to invest it, suddenly their standards slip and they have motivations that somebody who’s more disciplined doesn’t. You’ve got to stick tight to your own view and not let the market drag you into dangerous territory. Even if there are other players that are transacting at different pricing. You can use the new one as being sensible and sustainable and having good risk reward associated with it.

The thing that makes risk less intimidating a belief in solutions. Click To TweetWhat are you paying attention to right now as far as where opportunity could be? I know the universal perception of markets is always shifting but as much as there’s a risk, there’s always going to be opportunity as well. What are you paying attention to right now that you see as potential opportunity?

To some degree, we always trade wherever we see price disruption. As an example, the market for retail properties is disrupted. There’s a perception that eCommerce is going to be an overwhelming challenge and that retail properties are going to decline. As a result, the price of the properties has dropped and the cap rates have gone up significantly. We believe that the cap rates are very generous in that even if you underwrite into the equation, some downside is given eCommerce challenge or choppiness in the retail markets it’s very often that you can make a very good investments in retail. You have to understand and adapt it, understand the tenants and a million other considerations. That’s an example of disruption that we buy into.

Another area that we’re investing in at the moment is under-occupied office buildings. Right now, when an office building has weak occupancy for any number of reasons, it tends to trade at a vast discount from the state’s realized value. An office building that would have $150 valuation a foot. If it was the submarket occupancy, let’s say 85%. If its occupancy is 50%, the value of that asset might fall to $60 foot. They asked discount from what it would be worth if it was leased up. The cost of leasing up that asset could be $30, $40 a foot. You’d have wall and cost of a hundred. If it’s then going to be worth $150, that’s a very big reward in the real estate business. I don’t know exactly why office building sells it that heavy discount, clearly one that has significant vacancy is worth less that doesn’t. To us, it’s a mispriced factor. We buy those buildings and we fixed them up and then we become strong competitors in the market because we pay a lot less for our building than everybody else in the market. We can even rent them for a few bucks or less and the tenants are happy and we’re happy.

Do you see opportunities in shifting use of property? As you were speaking, I’m right in downtown Salt Lake and there is a shopping center here that was developed as part of the Olympics back in 2001. It had a competitor come in and take off the tenants and it became a ghost town. There was a fund that bought it a few years ago and turned it into this center for younger entrepreneurs. Since then, all of these different office buildings built around it. In there, there are mystery games like the games where you have to solve problems. I’m not sure if you’ve seen those before but they have arcades and hang out centers and restaurants. They shifted the use from pure retail into this center or hub for more tech-based companies and younger people. Do you see like use changing over the course of time and opportunities there?

Yes. As an example, there’s a property in West Palm. Before we owned it, it was a shopping center. The prior owner has given to us that it became somewhat of a ghost town and the prior owner converted it to B-minus office space, which is not ideal. Shopping center tends to be deep so the space is very dark. It doesn’t give a lot of window line for offices. It’s not perfect. They did some work and for a long time and when we saw it, we bought it because it was on a lot of land. It was on ten acres of land which in West Palms, it’s a big site. For a while, we kept the office building going but a lot of our tenants were government tenants. The government built their own buildings, they move people out. It wasn’t a market for this secondary office space. We made the decision to redevelop it. We’re now in construction. We’re making it into a 300-unit housing complex. We demolished the old building and now it’s going to be a housing complex that West Palm is very strong market. This’ll be an outstanding property when we get done with it. It’s life cycle. It started as a shopping center, it became an office building and now it’s going to be first-class housing. That happens frequently.

As you mentioned right at the beginning of it, that’s where it requires that creative mindset to see there’s always opportunity. It may not have been what it was once. It maybe something new based on how the environment is changing. That’s why I’ve been fascinated with researching ways in which I can interview you because the idea of risk is one of those things that prevents people from taking action. The creativity is also one of those things that I’m not sure if that’s something that you learn or establish. The idea of being creative allows you to see and create opportunities as opposed to it happening. This has been a fascinating conversation.

Risk Game: Self Portrait of an Entrepreneur

Another way to look at creativity and entrepreneurship is to think that every problem has a solution. The person who can find that solution is going to create value. Whether you’re buying a problem that somebody else has and find new way to solve that problem. If it’s a problem that you have because you already own it. It’s not like when there’s a problem, you should put your head in the sand and say, “OMG.” Most problems can be solved. Sometimes you have to be very imaginative. You have to be very creative. That’s the thing that makes risk less intimidating for me is a belief in solutions.

I love this saying that the problem is an unanswered question. This has been awesome. I appreciate you adding your insight based on your successful experience over the course of time. It sounds like you love what you do. You’re loving life and you’re continuing at it despite your success, after success. Congratulations.

Thank you so very much. I do like what I do. Every morning, I wake up and I’m excited to meet the day’s challenges and opportunities.

How can the audience learn more about you, your book and ways to keep in touch and see what you’re up to?

They can take one of my books online. It’s called Risk Game. At the back of the book, I have my email. If anybody has a question or anything they want to contact me about, I answer all my emails. I get up very early in the morning. From 4:00 or 5:00 until around 7:30, I am answering lots and lots of emails. That’s one way.

Francis, thank you so much. Hopefully we can connect in the future.

Patrick, thank you.

Important Links:

- Time Equities

- Sanford J. Greenburger Associates

- Art Omi

- Greenburger Center for Social and Criminal Justice

- Risk Game: Self-Portrait of An Entrepreneur

- The Thomas Berryman Number

- www.TimeEquities.com

- www.FrancisGreenburger.com

- www.GreenburgerCenter.org

- www.Greenburger.com

About Francis Greenburger

As the Founder and guiding force behind Time Equities, Inc., Francis Greenburger has earned a reputation for outstanding integrity and an uncanny ability to foresee changing directions and create value in a variety of real estate markets.

As the Founder and guiding force behind Time Equities, Inc., Francis Greenburger has earned a reputation for outstanding integrity and an uncanny ability to foresee changing directions and create value in a variety of real estate markets.

He is an active board member in and supporter of, various arts, education and community organizations, as well as the owner of Sanford J. Greenburger Associates, Inc., a full-service literary agency based in Manhattan, which has represented noted authors such as Dan Brown, James Patterson, Nicholas Sparks, and Nelson DeMille.

An accomplished writer himself, Francis is also the bestselling author of Risk Game: Self-Portrait of an Entrepreneur. Francis is the founder & chairman of Art Omi (previously Omi International Arts Center) and The Greenburger Center for Social and Criminal Justice. Francis lives with his wife, Isabelle and is a devoted father to his four children. He spends his free moments in search of the perfect backhand or skiing (carefully) down the slopes.

Love the show? Subscribe, rate, review, and share!

Michael E. Gerber is the founder of Michael E. Gerber Companies and E-Myth Worldwide. He has had nearly 100,000 business/coaching clients over his career and has consistently been called “the World’s #1 Small Business Guru” — the entrepreneurial and small business thought leader who has impacted the lives of millions of small business owners and hundreds of thousands of companies worldwide for over 40 years.

Michael E. Gerber is the founder of Michael E. Gerber Companies and E-Myth Worldwide. He has had nearly 100,000 business/coaching clients over his career and has consistently been called “the World’s #1 Small Business Guru” — the entrepreneurial and small business thought leader who has impacted the lives of millions of small business owners and hundreds of thousands of companies worldwide for over 40 years.

Mike Moyer is the author of eight books that provide structured advice to people who want to solve specific problems like splitting equity in their startup company or delivering an awesome sales pitch. He mostly writes and speaks about business and entrepreneurship.

Mike Moyer is the author of eight books that provide structured advice to people who want to solve specific problems like splitting equity in their startup company or delivering an awesome sales pitch. He mostly writes and speaks about business and entrepreneurship.

Dr. David Kelley founded The Atlas Society in 1990 and served as Executive Director through 2012, before serving as the Chief Intellectual Officer, where he was responsible for overseeing all the content produced by the organization: articles, videos, talks at conferences, etc.

Dr. David Kelley founded The Atlas Society in 1990 and served as Executive Director through 2012, before serving as the Chief Intellectual Officer, where he was responsible for overseeing all the content produced by the organization: articles, videos, talks at conferences, etc.

Sharon Lechter is internationally recognized as a financial literacy expert and keynote speaker. She is a New York Times Bestselling author, successful entrepreneur, philanthropist, and licensed CPA and CGMA.

Sharon Lechter is internationally recognized as a financial literacy expert and keynote speaker. She is a New York Times Bestselling author, successful entrepreneur, philanthropist, and licensed CPA and CGMA.