Conquering The Venture World With Thomas W. Jones

Podcast: Play in new window | Download

There are so many more opportunities to be found in the venture world these days, and it’s a good time to jump in. You’ll find that you’re able to make more now if you have some capital to put in. Patrick Donohoe talks to Thomas W. Jones, the former Chairman and Chief Executive Officer at Citigroup. Together, they speak of these opportunities for investment. Your path to wealth might just be down this road – if you know where to look. Let Thomas and Patrick show you the way!

—

Listen to the podcast here:

Conquering The Venture World With Thomas W. Jones

It’s truly is an honor to speak with this gentleman. His name is Thomas Jones. Thomas is a former Vice Chairman, President and COO at TIAA-CREF, the largest pension system in the country, one of the biggest financial firms in the country. He’s also the former Vice Chairman of Travelers of the Federal Reserve Bank of New York and Freddie Mac. He’s also the former Chairman and CEO of Smith Barney Asset Management and the former CEO of Global Investment Management at Citigroup, the former Treasurer at John Hancock Insurance Company, the Founder and Senior Partner of the venture capital investment firm, TWJ Capital. He’s also the author of a book called From Willard Straight to Wall Street. Thomas, correct me if I’m wrong, but were you also a part of ICI, the Investment Company Institute?

I was on the board at the Investment Company Institute for a number of years.

Of anyone to understand how investment has changed over the years as well as different types of investments, different types of companies within the financial services. Tom, I can’t wait to have this interview. I thought it would be great to start with some context for the audience to understand your perspective on things. I’d love to know as you were growing up and as you got into financial services in your career, who was one of your role models? A person that inspired you either someone you knew, somebody you didn’t know. Who were some of those instrumental people that helped form what you decided to do with your life?

I would say one of the most significant role models was John Bogle, who created a modern index fund. As an experienced investor, he understood the various characteristics of risk in both the equity and fixed income markets in the US. Through a long period of experience and reached their conclusion, it was a low probability that the average investor was going to outperform the average performance and efficient capital markets have evolved in the US. He came up with this idea that the most likely way to deliver efficient returns relative to risk for the average investor was to minimize the cost of making those investments, so that the net return over time would be maximized in a way that it compounds itself. I thought it was magnificent that somebody as brilliant as that would focus on trying to create a product that was designed to serve the common man, so to speak. Designed for the average investor and accessible to investors who weren’t necessarily wealthy with large sums to invest in able to pay high fees. That was contrary to the standard Wall Street model. I admire what he was doing.

That was one of those earthquakes in financial services. It continued to compound where technology is on the scene now and the awareness of information has pushed fees, expenses and transparency. It pushed all those down in transparency up and you were one of the founders of it.

It was interesting and totally going index funds didn’t attract much of a following. Frankly, index funds came up onto the scene in the late ’50s and early ’60s and weren’t considered to be much of a factor in the market or maybe 25 or 30 years. It’s been only in the last 25 or 30 years that it’s become powerfully evident that most active investors are not consistently outperforming an efficient index fund. There will be some outperformers every year, but the problem is that most investors can’t identify them in advance.

It’s too late by the time they know. Their track record, is it that way going forward once they have outperformed it?

That’s true also.

I thought another question that would be helpful for me to understand the career you’ve had, this success that you’ve had and the difference that you’ve made is to understand a superhero or a figure in history that has done amazing things, hero-driven things. Who have you most resonated with and maybe fit those criteria?

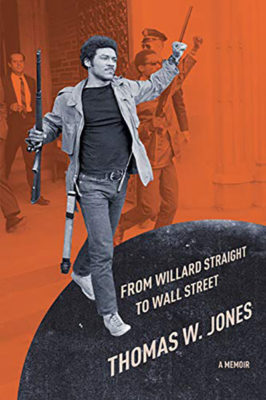

Most active investors are not consistently outperforming an efficient index fund. Share on XI was a bit of a student revolutionary in the 1960s. The cover of my book, From Willard Straight to Wall Street, shows me with a gun exiting Willard Straight Hall of Cornell University in 1969. That was a Pulitzer Prize-winning photograph. I’m on the cover of Newsweek Magazine in April 1969. I thought my generation of African-Americans was tasked by history to stand up and fight over the historical oppression that we had suffered in this country and to say that it had to end in our time. In that context of my hero, one of the people that I most admire was Martin Luther King, Jr. He made a way that he did change the conversation in this country that has hundreds of thousands of people doing things like participating in the march on Washington in 1963. Shaming America by personifying this high wall standard and saying that he was going to lead a movement that epitomized that high wall standard by doing a nonviolent movement and responding to hatred with love. I thought that was admirable and courageous and I admire him for doing that. Coming out of Willard Straight Hall with a gun was not a statement of love, it was a statement of resistance. I admire the way that Martin Luther King, Jr. elevated the civil rights movement and given it so much movement.

I always referred to some of the most inspirational, energetic, motivational speeches of all-time came from Martin Luther King, Jr. The reason why I asked the question that I did is you have figures in history or even in the fiction world that play this role, have this presence and state that is contagious to certain people that they resonate and essentially take onto their character. It’s fascinating because a person did stand for what’s right. The person did face the odds that were not in their favor, conquered, and made a massive difference in another earthquake in the world that set a new precedent. That’s awesome to hear about some of your heroes. Another question is what are some of the charitable causes that you have represented or continued to represent for support?

The one that’s closest to my heart was a school in Central Harlem, St. Aloysius School, which was focused on serving low income, predominantly black and Hispanic children, elementary and middle school. I became familiar with them in 1993 when I became the President of TIAA-CREF. There were a lot of newspaper articles about me and so on. One of those stories that were in the Wall Street Journal, I said that one of the ways I would like to make a difference was to support educational opportunities for inner-city children. Helping them to get better opportunities than were typically afforded to them. The lady who was the head of St. Aloysius contacted me and said, “If you’re serious about what you’re saying, you ought to visit us instead of starting something new, you want to work with somebody like me who was already in process.”

I followed up on that. I went to visit her and it was remarkable. She had these kids, the average kid. She had no special selection procedures other than you had to have a positive attitude. They had to be a person that wanted to engage positively for those. She oriented these kids through things like oratory, not the reading and the mathematics but oratory in a way they would give some of the great speeches that you would find in history. Learning how to understand those concepts and how to speak powerfully, resonantly, and emotionally. Through that process, imagining themselves being the machines and the footsteps of the great people whose speeches they were giving.

She also had side excursions going to museums around New York City, going to Broadway shows and it opened the eyes of these children to see what might be some of the possibilities beyond the daily horizons that normally were never experienced. I was impressed that we partnered with them. We started a program that was called the Courage to Succeed. I called it the Courage to Succeed because in a lot of inner-city communities, there’s a culture that reaches you back from success. There’s a culture sometimes where the kid who studies hard, the kid who tries to succeed in school, their teams. That’s not black. That’s not cool. I had faced that same thing coming up in my own life. I skipped two grades and that’s not cool. I had a mental shell, hard made of that but I knew these kids, it takes courage to stage that lack of cultural support.

I named the program the Courage to Succeed. What we did was donate computer equipment to the school with technicians from TIAA-CREF volunteering a couple of hours a week to go work in shifts to teach the kids various programs in schools. How to use the computers and the software we were giving them. The second thing was I recruited prominent, successful business people, African-American and Hispanic business people, to come and talk at school, tell their stories so the kids could identify with that’s somebody that looks like them and look how successful they are. If they can do it, I can do it too. The third thing I did was we were a sponsor of their annual fundraising efforts. We had an annual gala and win awards, which would raise $500,000 or $600,000 a year to support scholarships for the families that could not pay the modest tuition, $2,000 or $3,000. That’s something that not every family can pay. We raised the money to support scholarships for the kids. That’s been my favorite philanthropic endeavor.

I look at making a difference. I would say some of the stereotypes with charities are that you exchange money and support them because of their cause. Instead of that, it seems like you helped to perpetuate their cause by making a difference where it’s not giving a fish, but it’s teaching how to fish.

You’re trying to teach people how to fish, how to support themselves, how to be confident in themselves, how to lift themselves, how to see a way, how to see a road, how to see what an opportunity might look like.

We can go off on that topic for the entire show because the amount of influence that the children have especially around the teenage years when their bodies are changing, the chemicals in their brains are changing. There’s a huge part of their perspective that lingers throughout their entire adulthood is formed in those years. I look at how profoundly in good ways or bad ways, depending on the environment, how school influences that. We could go off on that, but I want to get to one other question for context then we can get into some of the meat of the interview. I’m grateful to you for answering the questions the way that you are because it shows who you are. It shows what you care about and even the purpose behind what you do. The last question I have for you is from a legacy perspective. If you could choose one attribute that you could impress on your children, your grandchildren, the world, and perhaps this audience. What would that attribute be?

If I had to pick one, it would be something I’ve talked about in my memoir. It’s the lesson I learned of the significance of giving 100% effort every day and try to excel at what you do. It’s a lesson I learned because when I started out in my career in the early ’70s, I thought I had no chance at all. I was going into the business world because I thought that’s where the toughest battle would be as America seemed to be opening up to more integration, inclusion, and racial equality. I thought the business world would be the toughest battle because that’s where the wealth is. I thought I would have next to no chance whatsoever because I was branded as the black radical supporter but I wanted to give it my best shot anyway.

From Willard Straight To The Wall Street

As I thought about how to approach it and to think which is unlikely that you’re going to succeed, I concluded that you have to have a framework of reference for success that you can control for yourself. You can’t be psychologically dependent on those around you to define whether or not you’re successful. My conclusion was the only thing I could control was my attitude, my demeanor, my work effort, my product output. If I had a positive attitude, if I always carried myself in a way that was respectful and friendly towards others, if I gave 100% commitment in my best every day, that could be my personal scorecard. Every day, I could grade myself on to do that to them. Things might not work out at all in the context of the companies and my assignments. I might get fired any day.

If I could give myself that scorecard every day, then that was the best I could do. I should be proud of that. As I made that commitment, I discovered that operating at 100% to try to excel every day is different than 90% or 95%. I had been socialized, like most of us, you’re socialized at school at 90% or 95% is an A and A is the best you can do. You should be satisfied with that. In fact, I discovered that there’s a big difference between 95% and 100%. It may not seem like a lot. Who cares? You got 100, I got a 95%, big deal. What are the five points? It may not mean that much on any given work assignment. It’s hard to push it into shades of gray about the quality.

That five points of differential effort and commitment, if it’s compounding every day, day after day, week after week, month after month, it becomes an enormous reservoir of differential effort and likely achievement that sets you apart. That was the basis of my career because I did not know it at that time, but the most successful people in Corporate America, the guys that reached the top, the guys that build teams, one of the reasons they’re at the top is because they have the teams. They can’t do all the work themselves. One of the ways they build teams, they’re like sports coaches. They’re always on the outlook for talent. People that they want to try to bring onto their team.

I did not realize it at that time, but some senior guys we had to pay attention to them unless they heard about me. They began to pay attention and people would show up if I was doing a presentation. A report that I admit and might have been read by a number of different people who then ask me questions about it and people would begin to approach me. It always started with discussions about work, conversations about my work efforts, my projects, clients. It would slowly engine to asking me about my family in the background and what my goals were. It would go a little bit broader into social, they would invite my wife and me maybe to dinner.

Ultimately, I was adopted by the whole series of people who became my mentors and they gave me the promotions, the compensation increases, and protection. I did need protection because not everybody wanted me to be in the company. People who would have fired me because I was the black radical from Cornell and people were like, “You don’t belong here.” I got protection, promotions, and compensation. That mentorship was a reciprocal relationship. I made them look good by the work I did and they took care of me. To come full circle, the point I would make is I learned through that 100% effort to achieve what I call self-actualization.

Self-actualization is your highest potential and you don’t know what your highest potential is. You put a 100% effort and to try to get there. I learned through doing that, It was a spiritual gift to myself because it was not only was it successful in a career sense or job sense, but I felt spiritually uplifted just the joy of knowing that you’re achieving your highest potential and being everything that you can possibly be. I recommend that to your audience because I guarantee you, it’s a spiritual gift to yourself to give 100% effort to be everything that you can be.

This is inspiring because if you look at the athletes in history, and I’ll refer more to the Olympic athletes. The gold medal winners are the ones that go down in history. They’re the ones that are celebrated. They’re the ones that people remember. The bronze could have been a fraction of a second off from the gold. The fourth place, no one even remembers. They look at the tiny margin that exists between those 1st, 2nd, and 3rd place. It’s incredible that the ones that go down in history, it’s a fraction, it’s a hair, it’s that tiny bit of effort. I’ve heard before that in our day and age, a good effort is going to give you poor results. An excellent effort is going to give you mediocre results. It’s an outstanding effort that gives you those moves. It’s a rung on the ladder toward Maslow’s self-actualization. It’s powerful that you say that because it’s not that those that succeed, excel and achieve that excellence do so much more than everybody else. It’s a little bit more than that threshold that most people stop at.

It’s a little bit more but they’re doing it for themselves. Nobody’s forcing them to do it. LeBron James is out on the basketball court as a kid at night shooting hoops. Nobody’s forcing him to do that.

That compounds, it creates the way in which you view your role in everything. That behavior side of things, it’s that compounding because the detection of making that little bit extra effort is noticeable. The other stuff is the cliché of people doing enough to get by.

You have to have a frame of reference for success that you can control yourself. Share on XIt becomes a way of life. It’s different that doing whatever you can get away with, which is the way some people approach work. You do as much as you need to do. What can I get away with doing? What can I skip doing now? It’s a different orientation to how you approach.

You look at the philosophy, you have everything you listed and then you look at your bio. I know there are other roles that you’ve played throughout your career but you’re not surprised. If you were to look at some of the philosophy that you have, the perspective you had, and then look at your experience, it won’t be a surprise. That’s what’s amazing. I appreciate you sharing that.

That’s one of the messages I try to communicate in my memoir. I want to tell you a second message, the second point, briefly. I wrote my memoir in part because I’m concerned about this negative tone that’s developed in the country with regards to the political divisions and cultural divisions, racial divisions, and we seem to form the negatives well incessantly. What’s wrong? What divides us? From my perspective, I look at this country now compared to America in the 1960s. I say that if you described America now to people in the 1960s, most people would have said this country could not possibly change that.

It’s impossible, but we have. It’s such a better country. We ought to give ourselves credit for how much the country has accomplished with regard to race relations and cultural issues. Even as we recognize, it’s not perfect. We still have ways to go. There’s much to do but give ourselves credit for how far we’ve come. That’s important to our collective psyche, especially if we raise a child, we can’t always be negative and saying, “You didn’t get this done and you didn’t get that done and you’re not good at this. You’re not good at that.”

If you’re raising a healthy child, you’ve got to praise them for their achievements and accomplishments and then say, “Also, there are some areas where you could get better, some things you want to focus on because that’s not quite up to par with other things that you’ve accomplished.” You’ve got to have that balance for the psyche because psychologically, you’re trying to help your kid understand that you are capable of these achievements. Look at how much you’ve done already and now there’s a little bit more that you also need to get done. That same thing is true of our society. I wrote my book in part to try to communicate that message that our country wants to be proud of how far we’ve come with regards to race relations, women’s equality, the LGBTQ acceptance in society. We’re a country. Nobody came in from the outside to impose these changes on us. The country has decided to try to live up to its higher standards, it’s higher ideals. We should be proud of how far that down road we are.

There’s a saying that I’ve connected with that is, “Pessimism gives you the crumbs of life.” There’s always going to be something wrong if you look for it, we’re humans. What’s right is also always there.

It is there. When I look at America now, I see that in every profession, law, medicine, business, every academic field, entertainment, sports, law, government, African-Americans have achieved at the highest levels, recognized and accepted. In the middle of fears of our society, millions and millions of African-American families have been lifted out of poverty through access to better education and better economic opportunities that have occurred in the last 50 years. An African-American has been elected president of the United States.

He’s one of the most influential presidents.

We should be proud of that. That doesn’t mean that Black Lives Matter doesn’t have a good point when they march and demonstrate against this violence against unarmed black men that occurs. The truth is, those kinds of incidents of violence against unarmed black men occur proportionately. The frequency was 50 times greater 50 years ago, and 100 years ago 100 times greater. I’m not sure we’ll ever eliminate it because it’s humans and there are going to be some bad apples who dislike other people for some nasty reasons. I’m not sure we’ll ever get rid of it entirely and Black Lives Matter is right to demonstrate and publicize the incidents which still occur, but at the same time, we should recognize the frequency is greatly diminished. We should recognize that it does not take away from how much our society has accomplished in the last 50 years. We could be proud of what we’ve done even as we recognize that we still have ways to go. We’re never going to be a perfect society. You still have ways to go.

The Venture World: You’re trying to teach people how to support themselves and be confident enough to lift themselves up.

We’re humans, we’re fallible. Since the beginning of time, anything that’s different or as perceived as different, people are afraid or are naturally afraid of. It goes to the caveman inside of us being afraid that the saber-toothed tiger is going to eat us in the morning. I look at that but I also see so much good that’s happening in the world. The news headlines, it’s easy to get the chemicals in our brain firing because of the negative things that are happening. There’s so much good that’s happening if you know where to look for it. We can go off on that. I believe that the focus that you have on how you show up with the different roles you have in life, there is going to be an overwhelming amount of things that are wrong, but there’s going to be as much more that you could be grateful for and what’s right. You have to look for it.

You have to look for it, you have to see it and you have to appreciate it. One of my tenets would be to associate yourself with those who are positive people, the positive events, the positive dynamics. You individually need to be a positive person and associate with positive people.

In the past, I’ve thought about disassociating with negative people. I don’t know if that’s always the thing. In the end, what influences a person that may be naturally pessimistic is you changing first, you adopt a different perspective, a different state in which you show up and that person over time will be influenced. It is having an awareness of that instead of assuming that a person is going to be influenced by you or by you. It shows that the people in the world that I would say are the most pessimistic are the ones that are suffering the most. You could be a positive influence on them if you understand these principles and then show up differently. That’s ultimately what’s going to be the greatest influence.

Tom, I wanted to get into investment and we’ve talked about our philosophy. I love what you’ve said and it magnifies the respect and admiration I have for you. A few questions on finances and investment. This life experience that you’ve had and the perspective you have in regard to yourself, life, our society especially the Western and the American society. How have you taken that to the financial world, whether it’s the way in which you’ve run these massive companies and the theory behind how they invest? You’re in the private sector as far as investment is concerned. It applies to the companies you invest in and aligning your philosophy with theirs. How have you taken what you’ve learned about life and brought that to the financial service’s roles that you’ve played?

I’d like to give you two examples. One is that more of a microscopic, personal level because your audience may have some questions with regards to how they can become wealthier. How can they be financially more successful? I want to tell you about the anecdote. When my wife and I got married, on our honeymoon in 1975, I said to her that one of the things I was thinking about was that we were both working professionals. We both have a nice income. I said I have thought that if we could, we should try to live on one income. If we could live on one income, save the other and have some money that we can invest and try to build economically, building an economic venture, this is the time to try to do that while we’re young.

I’m not sure what we would invest in but I know that in a capitalist society, you’re a lot better off having some capital to invest. Looking for opportunities to then build wealth by using wealth. She agreed, which seems self-evident 40 years later, but in fact, at that time it meant we couldn’t live the same lifestyle as many of our young dual-income friends. We couldn’t have the same clothes. We couldn’t go out to dinner as often. We couldn’t take the same vacations and so on and so forth. My wife agreed and within two years, we had a $25,000 nest egg. We lived in Boston at that time. One Sunday, I’m reading the Boston Globe and the Boston Redevelopment Authority and some ads for abandoned properties that they had taken over, which were available for redevelopment.

We lived in the south end of Boston, which at that time was in the early stages of urban renewal. One of the properties that the Boston Redevelopment Authority advertised was too boarded up, abandoned, burned out, brownstones about a little over two blocks from Copley Square in Boston, which is hard to believe now as much as that area that gets developed. We put in an application to redevelop those two brownstones. We were the only people in the whole city of Boston to even bid on it. It’s a long story, a lot of hurdles, a lot of tough stuff to deal with. Three years later, we had completed a ten-unit, totally refurbished apartment building.

We lived in one of the units, the top floor. We had a two-bedroom apartment with a roof deck that was overlooking Copley Square. The other nine units were cashflow positive. The building was cashflow positive within a year, which meant that income was paying down the mortgage which accrued to our benefit, and then in that era there were all kinds of tax advantages to owning investment real estate. We were living essentially rent-free while the asset was growing in value. It then ended up making hundreds of thousands of dollars out of that initial investment. That’s a microcosm of how you get from nowhere to somewhere in America financially. It’s not what you earn on your job, it’s what you do with what you earn.

You need to try to accumulate some capital somehow so that in a capitalist society, you need to have the advantages of having capital work for you so that you can get the capital gains and the income that is thrown off by capital. That example I gave you, Wall Street is a million-scale magnification of what I described to you. More complexity in some of the kinds of deals, but as essentially various versions of there’s an equity piece of capital, there’s some debt layer around it. There are some assets, be it a building or be it a business. You’re trying to build that asset with the combination of the equity and the debt. If you’re successful in building that asset, it pays down the debt for you. You end up owning the whole thing even though your equity portion was only a fraction of what it costs. That’s what happens in capitalist economies. You need to understand that and make it work for you personally.

Associate yourself with positive people, events, and dynamics. Share on XThere’s a saying I love, which is when you have the capital or liquidity, opportunity seeks you. It’s not that it wasn’t there before, it was always there. If you don’t have the means to do, your brain doesn’t see it. It’s an interesting phenomenon. I love that example. Let’s fast forward to now because you’ve taken the wealth of knowledge that you’ve accumulated over the course of time and experience, most importantly. Now, you run a VC type of fund and you’re investing in different companies and other assets. What are you paying attention to? What do you see as the opportunity that exists right now? There are a lot of things that you could focus on that are negative. At the same time, there are also a lot of positive things that you can focus on. What are you and your investment strategies focused on right now?

When I started several years ago with the venture business, this has changed a little bit, but my theory at that time was at venture capital that becomes something of a concentrated industry. Most of the capital, so to speak, under the control of a relatively small number of medium and larger size venture capital firms, typically on the East and West Coast. These firms had accumulated such large pools of capital that smaller deals, meaning $5 million and $10 million type deals, didn’t move the needle for them. Meaning if you’ve got a $500 million fund, a $10 million deal is 2% and it takes a lot of work. If you’re going to try to make your fund successful with doing deals that are only 2% of the fund and it takes as much work, due diligence, document structuring and so on to do a $10 million deal as opposed to doing $50 million. My theory was there’s an inefficiency that’s developed in this marketplace, what I would call a smaller commercial size, smaller industrial size opportunities don’t have as much money, don’t have as much sophisticated investment money looking at them as doing larger transactions. That was true at that time.

Shortly after we got started, we had a $60 million fund and I would network. Over the course of my career, I’ve come to know a lot of people. One day, I’m having lunch with somebody I had known for a number of years. She’s also an investor and she says, “Tom, we’re in this deal with a company called Floor & Decor Outlets of America. We do hard surface stone tile. We helped them to grow to five stores. Entrepreneurs started out, we helped them grow five stores but they have violated one of the deck covenants that support their inventory. The bank was going to pull the plug in the next 60 or 90 days.” It says, “We’re at the limits of how much money we can put into the deal. Would you be willing to consider investing?” I said, “I’ll tell you that I will do my diligence. I could do that. I will do an intensive look at it and I could give you a decision within that timeframe, but I’m not going to promise you that we’ll do it.”

I went and I spent a lot of time with the entrepreneur and it turned out the entrepreneur, the leader of the company, was a brilliant entrepreneur by the name of Vincent West who had family company down in Georgia that had been wiped out by the early stages of Home Depot. This guy, Vincent as a kid, had learned this business, the stone, the tile, ceramics, different types of wood. He developed relationships with all the sources of this product around the world, the different quarries, the different manufacturers. His idea was this, he says, “If you are remodeling your house, you had your interior designer come. He gives you some ideas, you like the ideas. You go down to the tile shop, you see something that you like, you order it there. It goes to six different pairs of hands because the tile shop doesn’t have it in stock. You’re going to order it from the distributor and the distributor doesn’t have it in stock. He’s going to order it from the importer. The importer’s got to get it, place it to the shipper and everybody’s adding 20% markup.”

His idea was to let me import a unique product. I’m going to put it in 50,000 to 60,000 square foot warehouses. I’m going to put up these beautiful examples, almost artistic types of examples using that product. Here’s what you can do design-wise with the product so that when you come in with your interior designer, if you see something that you like, it’s right there in my warehouse. This eliminates one of the problems. He says, “When you go to the local design store and you see something you like, when it finally gets imported through all these different pieces of hands, it may not even be the same as what it looked like in the store because it’s coming from the quarry. It’s coming from the rock. Some of the little colors in it, the grains may be a little bit different.” This was his idea. The problem with this type of business model is that you have to be precise with the modeling of your revenue versus cost because although your cost is upfront, you’ve got to get the store, you’ve got to get all the inventory into the store, you’ve got higher roles of people to be in your store, you’ve got to train them. All the expense meters running. Unless you understand how the revenue currently builds, it’s easy to run out of cash. This was the problem.

When I did my due diligence, I figured this guy has a business model through these five stores that they’ve got going. He’s got a good idea and it looks to me like they pretty much learned to operate the model but they made a few errors with regards to some of these unpredictable, tiny variances. I offered them a deal. I’ll put in $2 million and cure the bank covenant default. People think you’re going to screw up in a circumstance like that. I said, “What I’m going to do is I will come in pari passu with the economic terms of your most recent rounds. That’s generous. Here’s what I want. I’m going to be pari passu economical but I want a separate class of securities. If your last round was series B, I want a separate round, which is series C or series B1.”

Series B1 covenant, you’re going to say that under circumstances where everything’s fine, budget and all of that, everything’s pari passu. There’s going to be a whole list of conditions if we miss budgets, if we have any defaults on bank debt, if we want to raise new debt, if we want to raise new equity, anything like that you’re going to have to have a majority of the series B1. In effect, I have negative control. If everything goes well, we will all share the economics. If there are problems, I’ve got the seat at the table. To make a long story short, I put in $2 million then a couple of years later, I put in another $2.8 million. We grew that out to 25 schools to $250 million in revenue runway. We sold it to Aries Capital Management out in LA.

They scaled it up to over 50 stores and they took it public. FMD is the symbol on the New York Stock Exchange. That’s the thing that we do. A $2 million initial investment is scaling-up $4.5 million and that was a ten-bagger for us. A larger fund wouldn’t even look at a deal like that. Let me make one last comment. What is changing though and this has got me concerned, there’s a lot more money in the venture world these days, a lot more angel groups, there’s a lot more money chasing every opportunity. If we do one deal a year during a period like this, that’s a lot because there’s a lot of money chasing them. What happened was we work in terms of the market saying this is crazy. They’ve gotten out of control. They’re throwing money at a guy and they’re losing hundreds of millions of dollars a year. I hope that’ll bring some sanity back into the marketplace.

There’s a big article in the Wall Street Journal that talked about $100 billion or so disappearing. A lot of it was initiated by WeWork debacle but not just that, it’s also what happened with Uber and some other companies that were betting on a certain valuation. What I wanted to get into because I totally love this train. Going to where your expertise had been established over the years and with this deal, what were the ingredients of your engagement in the deal? Number one, it was the actual individual, the entrepreneur behind the company. The second ingredient sounded like understanding their finances, understanding where their finances, where their costs and then what costs would be and as well as revenues if they start scaling. Another ingredient that I picked up on is the terms of the deal. Was there anything else in there as far as your recipe for a good deal that you use consistently with some of the other deals that you do?

The Venture World: There’s a lot more money, many more angel groups, to be found chasing every opportunity in the venture world these days.

You’re accurate. First and foremost, what is the product? What does this company do? What problem does it solve? In the case of FND, it was solving that problem of going through multiple layers of mark-ups in order to home improvement supplies that were attractively done and artistically set up. What’s the value creation that accrues from your product because the value creation tells you here’s what people are likely to pay for it. This design or setup enabled them to get 40% gross margins even while they were selling at 40% less then you would have paid in the local tile store. That was the value creation. The third one was the people. I’m not saying it’s always in that order but those are the three elements. What is the product? What’s the value equation for you? Who are the people? What’s the quality up to you? At the end of the day, you’re betting on people but good people can fail if you’ve got a poor product concept or a poor value equation. The other thing also happens, you can have a good product concept and a good value equation but if you don’t have good people, that doesn’t work either. You need all three of those elements.

This has been fascinating. The best way I would say to learn about you is going to be from your book. Anything else that you’re doing whether it’s anything online or anything that’s public other than your book where people can learn more about you, learn from you, learn from your expertise. What’s the best way for people to connect with you?

My Facebook page, From Willard Straight to Wall Street. We focused around the book but on a regular basis, I get comments on that Facebook page. My website is TWJCapital.com. You’re going to see a little bit of information about the investments we do.

The best way to get your book is through Amazon or any publisher? What’s the best way to do that?

Amazon has it. They also have an audio version which is done by Audible. If you’re one of those people that while you’re driving and like to listen to the book, you can get the audio version at either Audible.com. Since Audible is owned by Amazon, that’s also available through Amazon, From Willard Straight to Wall Street.

In a capitalist society, you're better off having capital to invest in things. Share on XTom, this has been such a pleasure. Thank you for sharing all that you’ve shared. There are some fundamental principles in there that I’m excited about. Hearing it from you makes me even more excited. I’m grateful for you taking the time to be with us. It’s been an incredible interview. Would you like to depart with any final words?

I would say thank you for taking the time to do this. To me, it’s an example of what the opportunity of social media is. We see so much that people say social media is negative. This is an example of you’re being able to take the time to develop this topic. There’s a wonderful example of how you can add value through social media. Thank you.

Thank you, Tom. We’ll have to have you on again.

I look forward to it.

Important Links:

- TIAA-CREF

- TWJ Capital

- From Willard Straight to Wall Street

- Black Lives Matter

- Audible.com

- www.TWJCapital.com

- From Willard Straight to Wall Street

- https://www.Amazon.com/Willard-Straight-Wall-Street-Memoir/dp/1501736329

- https://www.Facebook.com/TomJonesCornell69/

About Thomas W. Jones

Thomas W. Jones is former Chairman and Chief Executive Officer of Global Investment Management at Citigroup, and former Chairman and Chief Executive Officer of Citigroup Asset Management with approximately $500 billion assets under management. Mr. Jones was appointed asset management CEO in August 1997, and sector CEO in August 1999, and continued in that capacity until October 2004. This business sector included Citigroup Asset Management, Citigroup Alternative Investments, Citigroup Private Bank, and Traveler’s Life & Annuity.

Thomas W. Jones is former Chairman and Chief Executive Officer of Global Investment Management at Citigroup, and former Chairman and Chief Executive Officer of Citigroup Asset Management with approximately $500 billion assets under management. Mr. Jones was appointed asset management CEO in August 1997, and sector CEO in August 1999, and continued in that capacity until October 2004. This business sector included Citigroup Asset Management, Citigroup Alternative Investments, Citigroup Private Bank, and Traveler’s Life & Annuity.

Prior to joining Citigroup, Mr. Jones was Vice Chairman and Director of TIAA-CREF since 1995, President and Chief Operating Officer from 1993-1997, and Executive Vice President and Chief Financial Officer from 1989-1993. Mr. Jones was Senior Vice President and Treasurer and other positions with John Hancock Mutual Life Insurance Company from 1982-1989, and spent the previous eleven years in public accounting and management consulting primarily with “Big 8” public accounting firm Arthur Young & Company (predecessor firm to Ernst & Young).

Mr. Jones is a Director of Assured Guaranty Ltd, and Trustee Emeritus of Cornell University. Past board positions include Vice Chairman of Federal Reserve Bank of New York, Altria Group, Freddie Mac, Fox Entertainment Group, Travelers Group, Pepsi Bottling Group, TIAA-CREF, Eastern Enterprises, Thomas & Betts Corporation, Howard University, Investment Company Institute and Economic Club of New York.

Mr. Jones holds Bachelor of Arts and Masters of Science degrees from Cornell University, and a Masters of Business Administration degree from Boston University. He has been awarded honorary doctoral degrees by Howard University, Pepperdine University, and College of New Rochelle. In addition to these accomplishments, Mr. Jones is a Certified Public Accountant and author of the new book From Willard Straight to Wall Street: A Memoir.

Love the show? Subscribe, rate, review, and share!