Capitalizing On The Massive Economic Shift Through Multifamily Real Estate With Michael Becker

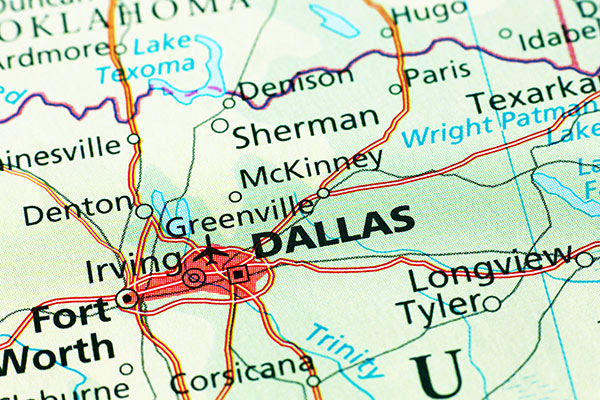

There is a massive economic shift going on that comes with a corresponding demographic shift towards areas with lower living costs and tax requirements. In what way is this development conducive to multifamily real estate? Joining Patrick Donohoe on the show, SPI Advisory Principal Michael Becker invites us to take a look at the case of Texas, specifically the DFW market, and how the changes going on in the economy are giving rise to massive opportunities to invest, whether actively or passively, in this no-income-tax state. Whether you’re looking to set up your own mom-and-pop or you just want to let your money do the work by involving yourself with REITs or syndications, terms are going to be very favorable for you in Texas and other areas that have been at the receiving end of the massive in-migration of people and businesses from more costly metros like New York and California. Join in to learn more on how you can start to build more wealth by capitalizing on these changes!

—

Watch the episode here:

Listen to the podcast here:

Capitalizing On The Massive Economic Shift Through Multifamily Real Estate With Michael Becker

My guest is Michael Becker. He is the Principal at SPI Advisory firm and also the host of The Multifamily Investing Podcast. You can check him out at MultifamilyInvestingShow.com. I wanted to have Michael on for a few reasons. First, I had Ken McElroy on a few episodes back, speaking about what’s going on in the economy in multifamily investing. I wanted to have Michael on as well to emphasize some points that Ken and I talked about then in that show. Many real estate investors start out excited. They see potential, opportunity but it becomes a job of sorts, hence the word active.

What I’ve seen is people gravitate toward more passive types of investment. Multifamily investment is an excellent way for accredited investors mostly to invest for cashflow in a passive way. The second reason is I believe our economy is shifting. Richard Duncan was on a few episodes back, and we spoke a lot about what’s going on in the economy, what’s likely to happen and what’s happening. It’s causing some seismic shifts. You are having some big capital flows impact things. You also have immigration, people moving from state to state based on the ability to work remotely, leaving a high cost of living areas, high tax areas. You also have a gist of emotion that’s driving investments up, driving some investments down, fundamentals are out the window and there’s a lot more. Multifamily is an ideal way to capitalize on some of these shifts.

It’s dependent on the market, but I wanted to have Michael on because his specialty is Texas. I look at the economy and human nature. It’s not a straight line. It’s not always predictable. In fact, I don’t think it’s predictable that often. There are variables that can lead to outcomes. At the same time, humans are odd where they make decisions that are irrational and subsequently cause their behavior, what they do to not be a straight line, but to be more of a curved line. We’re seeing that with a lot of movement out of high-income tax states like California, into states like Utah, Nevada, Arizona and Texas, which is a no-income-tax state.

This movement is going to continue. That’s how people behave when there’s more money taken from them, where there’s a high cost of living. I believe that Texas has a very interesting economy and there are a lot of people that are moving there. There are additional benefits to multifamily investment and there are risks. Make sure you do your due diligence. I’ve known Michael for several years. I think you’re going to enjoy the interview and make sure you go check his podcast out and learn more about investing passively in multifamily. Thanks, guys.

—

Michael, it’s awesome to have you on. First off, congrats on your podcast.

Thanks for having me on. It’s been a while.

First, talk about your podcast. How’s it going?

People stay in the rental pool longer now that they would have many years ago, further increasing the demand for multifamily real estate. Click To TweetIt’s good. I’ve been the co-host of the Old Capital Real Estate Investing Podcast for many years. In 2020, I started a show called The Multifamily Investing Show with Michael Becker. It’s a video-audio show done in a studio. I’m focusing on high-level guests in the multifamily industry brokers, owners that own tens of thousands of units. If you’re an apartment nerd, it’s probably a place for you. We’re talking about the industry and all the various things that go into it.

It’s an interesting time. With COVID, housing and markets have been shaken up because of relocation. A lot of companies are moving to a hybrid or full-on remote working environment, which makes a lot of sense. People have figured that dynamic out. Maybe speak to what you’re seeing with regards to occupants of multifamily, apartment complexes and what the behavior is of people. Reference specifically Texas because I know Texas is the recipient of a lot of immigration.

It’s important to talk about the perception or view I have of the world is coming from you, from Dallas, Texas. We own multifamily properties in Dallas, Austin. We’re expanding into San Antonio. That’s what my lens of the world is colored with. We’ve done about 10,000 units in the last decade or so. We own about 6,500 units give or take as I talked to you between Dallas-Fort Worth and Austin is where we’re focused. That matters because if I’m sitting here talking to you from New York City or San Francisco, I probably have a different lens of the world than what I do from Dallas.

It’s funny, we’re in this backward world and a lot of ways where generic suburban multifamily, and Dallas-Fort Worth trade at lower cap rates than multifamily on the Island of Manhattan does and whatever world have you been in where Manhattan Island has a higher cap rate than a generic Dallas does. It doesn’t make sense in a historical context. It’s been an interesting year. We’re at the end of Q1 2021. This time in 2020 where I’m stuck in my house and wondering if we’re going to collect rent in April 2020 because everything started to shut down in mid-March 2020. Every day we are wondering if we’re going to collect 50% or 60% of our rent.

The reality turned out to be much better. In a normal month going into COVID, we’d probably have about 1% of our scheduled rent is be delinquent or non-collectible. We’d collect 99% or better. In the early months, we went from about 97%, 96%. The worst we got was probably around Christmas time between Thanksgiving and Christmas, we got to about 95%. We collected about 5% to 6% delinquent portfolio-wide in Dallas-Fort Worth. That’s not great, but it’s manageable. We’ve seen an uptick as we get to Q1. Seasonally, a lot of our tenants every year around Christmas time prioritize buying Christmas gifts over paying rent. That’s a normal high watermark for delinquency.

We’re doing well. Occupancy is full. We’re 95% plus across the portfolio over 6,000 units on average. That’s higher than what it has been in the last several years. Places are full. We do have a small contingency of people within our units that are multiple months behind and they have the eviction moratoriums. Most people probably have heard or read headlines about the CDCs, put some eviction moratoriums in.

As we are talking, it’s about to expire, but we anticipate the Joe Biden administration extending that, but the counteract that we’ve been seeing, some of the stimulus money from the December $900 billion stimulus bill, and then I was added on with the $1.9 trillion stimulus bill out of some rental assistance. We’re in the process of probably collecting 75% or 80% of those large balances that we otherwise would have evicted those residents. The 75% or 80% of that would probably be collectible. I have manually written that money off. It’s going to be like a windfall. Magic money comes out of nowhere or maybe there’ll be no ramifications. We’ll see what the real-world ramifications are.

It’s one of those give and takes. When you put those eviction provisions in there, even though people might be able to pay their rent, they’re not. The mortgage industry from those who owned homes, being able to go into forbearance without having to be foreclosed on, people may have had the capacity to pay their mortgage, yet took advantage of that. That dynamic is interesting too. If they include those elements of the stimulus bill where they would pay back landlords, it would have been weighted in the favor of tenants and would hurt landlords.

It’s obvious that they put those different points in the bill to pay back landlords for the bill that they were paying over the course of time. Maybe speak to the role that multifamily is playing in society nowadays. The big apartment complex, who’s the tenant, why is there demand? Where are we at with the cycle of demographics and the demand especially in Texas for housing, specifically apartments?

Multifamily Real Estate: The current demand for multifamily comes from a variety of sources, from young people right out of college, all the way to empty-nesters and a whole bunch in between.

It’s a variety of sources for demand anywhere from young people, right out of college, or young working professionals, all the way to empty nesters and a whole bunch in-between. It’s across the current of all society types and depending on the type of asset you own. We own anywhere from workforce housing to brand new Class-A stuff. We see a little bit of everything, but in your workforce housing, it’s a lot of blue-collar-type tenants. People that work manual jobs, construction, work at Starbucks, serve your coffee in the morning, to the nicer newer stuff where you rent or buy by choice more than necessity. Where either you want to be in the urban coordinator amenities when they were open and active.

We’re starting to come back a little bit. That was a lot of your gateway cities people that want to be next to the museums and the restaurants, the nightlife and etc. There were a lot of suburban people as well. We have a lot of suburban multifamily in my portfolio. We get some families in Dallas-Fort Worth disbursement of jobs is not just concentrated in the urban core is well dispersed throughout the metropolitan areas is a bunch of pockets of employment throughout the whole region. People want to live close to those suburban jobs. It’s a little bit of everything and seeing the demands insatiable. A lot of that demands are driven here locally by the migration that we’re seeing, a lot of the corporate relocations that have taken from the higher-tax states, predominantly California.

We see a lot of California reloads to Texas for big corporations. They bring people or jobs and hire people locally. We’ll get a little bit of a transitory population. A lot of people come into the market. They don’t typically buy a house. A lot of the large segment of the population doesn’t buy a house out of the gate to go rent for a year or two until they realize that they want to stay in the area and then to find out what part of town fits their lifestyle best, then be in such a large metropolitan area. We were like 7.7 million people. We are the fourth largest metro in the country which should surpass Chicago in the next many years.

There’s a lot of cross-market movement as well. People will move from this part of town to that part of town. Austin, which is the other market I focus on is a little bit younger city than Dallas-Fort Worth even. You get a lot more tech jobs. It’s more liberal than the greater Dallas-Fort Worth area. There are a lot of people coming from the Bay Area who tend to relocate to Austin. That tends to be a higher rent or concentrated market than even Dallas-Fort Worth.

Every market is different. Some markets are different. It’s across all current populations across demographics cross country. You see a lot of younger people not married. The natural delay of people getting married gets older and older. We tend to see in our renter demographics, people stay in the rental pool longer than maybe they would have many years ago when you and I were probably renting out first apartments before we got married and had houses.

Speak to how does someone invest in apartment buildings? There’s clearly an opportunity, especially in Texas, with the demand coming in and most likely is not going to end anytime soon. How does someone invest? You have some of the institutional types of investments, like real estate investment trusts. You’re starting to see more crowdfunding opportunities. What are the different and predominant ways? Speak to the way in which you’ve learned to set up investments so that people can invest?

It’s anywhere from a mom and pop landlording where you go buy a ten-unit deal with your own money, run it, collect rent yourself, and fix the leaky toilet yourself, all the way to sophisticated institutional ownership groups that are public and trader reaps that are best institutional quality properties and everything in between. We’re in-between where I’m an apartment syndicator. It’s what I think of myself. We do private equity. We raise capital from high net worth individuals. I know you had Ken McElroy on, our mutual friend. I do a very similar model to what he does, where we go raise from high net worth individuals $100,000 at a time.

The syndication model is popular nowadays and it’s much more popular than many years ago when I got started. The crowdfunding was starting with the JOBS Act in 2012 when that came out, which allowed you to raise money from people you don’t have a preexisting and substantive relationship with, so you can do advertising and that’s when all those crowdfunding portals popped up. What I’ve found through my raising $250 million to $300 million equity that we raised over the last decade or so, people do business with people they know, like and trust. You can try to have all this technology, which is great to be efficient, but at the end of the day, if they don’t, one, get to know who you are. Two, get to know, like and trust you, and didn’t find you credible, they’re not going to invest in your deal.

There are certain timeless principles in real estate, but at the end of the day, markets are always going to shift. Click To TweetA lot of it is going to different real estate investing clubs. We have a podcast. Referrals are big things. Getting out there, getting network, and knowing people, getting referrals, that’s where we source most of the people that invest with us. From there, we take all different types of investment from cash. People have money to buy their trusts and LLCs. Retirement is a big chunk of that as well. A lot of people invest through self-directed IRAs or solo 401(k)s, and they get it out of the financial system, and the main mainstream financial system through Wall Street, and put it in the “alternative investments” like multifamily, syndications or the likes.

That’s how it is. It is evolved quite a bit with the crowdfunding platforms. You can take that software and raise money efficiently. It’s all virtual through our online portal and you fill out paper electronically wired, and it’s streamlined where we first started out. You had to email someone something, they print it off, hand fill it, scan it or fax it back to you. There’s a lot more laborious. It’s been a good transition from a technological standpoint and moved the industry forward quite a bit.

As you’re raising money or private capital, where has the focus been? Are there opportunities that exist that you’re buying into, or are you buying into dilapidated complexes that you fix up? Especially based on demand, are you seeing opportunities to develop ground-up projects?

Everything in the above is something that works. What we focused on when we first started out, we did a lot of workforce housing. Texas in the 1960s or 1970s, that’s when we first started seeing large-scale multifamily properties built in the region generally speaking. That’s most of our older stock. We’re not like New York where you can buy a 100-plus-year-old building because Texas didn’t have very many people. Hundred years ago, we didn’t have AC. Most of our apartment stock is a lot younger than if you’re in the Northeast then, their C-class stuff might be 100 years old, where our stuff is 40 or 50 years old. Buying that, renovating it, increasing the rents through renovations, that was very popular, still is nowadays with where we’re focused.

Over the last many years, we’ve been slowly transitioning in older stuff, buying newer, better, bigger. This has been a function of the marketplace where when I started out there used to be a larger spread. The rates of returns, you can get by buying older, tougher deals compared to newer deals. Commercial real estate, multifamily included trade on cap rates or what we call Capitalization Rates. It’s like your unleveraged return. If I were to buy a building that produces $100,000 in net operating income, so all the income that I get is less all my operating expenses excluding my debt. If I produce $100,000 and I bought it on a 10 cap, I would pay $1 million for that $100,000 income stream.

If I bought it on a 5 cap, I’d pay $2 million for that same income stream. My rate of return would be 10% if I paid $1 million or 5% if I pay $2 million. What happened many years ago to nowadays is those cap rates used to be maybe 3% of point spread between the top of the grade and the bottom of the grade. I’d pay an 8 cap for a C class deal when I started and a 5 cap for an A class deal. Now those cap rates are basically on top of each other where most of these caps are somewhere around 4% nowadays in Texas. We’re irrespective of location quality. To me, it doesn’t make as much sense to pay the same or similar cap rate for something built in the ‘70s that I can for a brand-new deal.

We’ve been trading up and buying bigger, better, nicer things and getting similar cap rates. That’s been the evolution of our business over the last many years. It’s been a good trade for us. They are developing it. People keep moving here. We need to supply more housing because there’s a demand for it, especially in Dallas-Fort Worth, and also markets where I predominantly focus. If data is done well and right, that certainly is a good business model as well. You have different levels of risks because you start a project now and two years later before yet you start leasing units and collecting rent. A lot of things can happen in between then. You hear the headlines all the input costs, labor, land, lumber in particular, are all going up. You could start a project with certain economics and then lumber, which is maybe 15% or 20% of your costs could double, then that could blow your profit out quickly.

Speak to the economics of interest rates too because you’re not buying these things in cash. You’re raising private equity, but then you’re utilizing a mortgage and debt. From what I recall, that’s your background. It’s where you started in the financing side of multifamily. What’s the market nowadays, and why has that helped with the opportunity in multifamily?

My professional background is in commercial real estate lending. In the last part of my banking career, I focused on multifamily lending and that’s how I cut my teeth in the business. One thing I’ve learned from being a banker and a borrower for a long time is whatever the environment is, it’s always changing over time. You’ve got certain principles that are timeless, but at the end of the day, the markets are always shifting wherein the multifamily space, the agencies, Fannie Mae and Freddie Mac are the two largest lenders, not only single-family space, but they’re the largest lenders in the multifamily space as well.

Multifamily Real Estate: We need to supply more housing because there is a demand for it, especially in the Dallas-Fort Worth area.

The only lenders that were loaning money this time in 2020 where the agencies were Fannie Mae and Freddie Mac because of a mandate to do it and all the other lenders shut off. It was impossible, but it was next to impossible to get a loan that was in an agency loan because there are so much fear and uncertainty in the marketplace. It’s turned off. For the better part of 2020, if you wanted to buy a multifamily property, you are going to get a most likely a Fannie Mae or Freddie Mac loan. They have these caps that are mandated by the regulator FHFA.

They started getting full because that was the only game in town. To slow the demand, they started increasing their spreads. They charge on the interest rates of their indexes, the ten-year treasury or LIBOR, depending on which you floated or fixed it. They’d become less competitive. At the same time, the alternative lenders like your banks or life insurance companies, they have some debt bonds out there that are prominent popular. Those were completely on the sidelines. Now they started loaning money, and then they realized that they didn’t loan any money in 2020 or they’re way behind their projected goals. They needed to get some assets out. They started getting a lot more competitive on the leverage that their offer, interest rates, fees, etc. They’ve been trying to win the business.

The marketplace nowadays is shifting, and we’re doing a couple of deals where we do a bank loan, and we’re about to do a life insurance bridge loan where before it would be 100% Freddie Mac loan, where nowadays is not. It’s always ever-evolving. That’s one of the things that you need to stay on top of, and what’s separates the good from the better within the industry is paying attention to the debt because it’s 65% to 75% of the capital stack with the remainder 75% debt and 25% equity. It’s a large part of the business and staying on top of that.

It’s the key. It’s always evolving and ever-changing, but the multifamily space is a darling of the commercial real estate industry. We get the most favorable terms relative. Let’s say, like an office building, a retail building, or a hotel, they have much inferior debt markets than what we have in the multifamily space are. It helps the returns and then the environment that we’ve been in for several years. Particularly, in 2020, we’ve seen extremely low interest rates. It makes the returns you can get on your assets go up quite a bit. That’s why we’ve been seeing these cap rates get lower because people were able to pay more for that same income stream because our cost of capital is lower. They can produce similar returns even if they have to pay more because the debt market is low.

In the first quarter of 2021, we’ve seen rates take back up on the long end of the curve, but on the short end, your LIBOR, SOFR, the indexes are 1 and 11 basis points respectively nowadays so it’s zero. All these adjustable-rate mortgages, we took out a couple of years ago. In other words, I’m printing money on those deals because these indexes are zero. We have many loans out that have a sub 2% interest rate on them that we took out a few years ago. It’s a free money, which is unbelievable.

You know Richard Duncan and I had him on. He was talking about the massive amount of excess reserves that banks are carrying. It’s going to continue for quite some time as far as 2021 is concerned. The interest rates are going to keep it that low. Michael, let’s wrap up with two points. Describe what you’re seeing in some of the stimulus bills in regards to multifamily. I know we briefly touched on how eviction moratoriums were in place, but now part of the stimulus is to essentially pay back those missed rents. Can you speak to that, and other provisions you’re seeing, and the $1.9 trillion? In the end, speak to your typical investor. What are they looking for? What’s their financial profile so readers of the show can identify with that, potentially reach out to you, and learn more about multifamily or at least start listening to your podcast.

With the $900 billion stimulus that passed in late 2020, they had earmarked about $25 billion approximately for rental assistance within that greater bill. That money was distributed to the states. The states and local housing authorities would then disperse that money. It took a while to get the programs going. In February 2021, they started rolling out in Texas and every state has different rules, but they were allowed to go back to March of 2020 and three months forward. At this point, you could get it. If someone had not paid me their rent in the whole year, I could get a whole year with a back rent plus three months’ forward to get caught up. There’s some paperwork to fill out that both on the property and on the resident side that proved that their loss their income.

We had over 6,400 to 6,500 units. We had somewhere around $600,000 in accrued accumulated deferred rent over that twelve-month period. That’s relatively instead of getting on a percentage basis in the grand scheme of things. It’s a lot of money in the real world. We anticipate that we’re probably going to collect $450,000 to $500,000 of that. That would tell you if there’s about 75% to 80% of that. I tell you there’s probably 20% to 25% fraud within the system where these residents could have otherwise paid, just said that they didn’t have a job.

Multifamily is the darling of the commercial real estate industry. It tends to get the most favorable terms. Click To TweetThey filed a fraudulent CDC declaration to stay an eviction. That’s what roughly I’m deducing from what we’re about to experience so then those people are going to be evicted and credit ruined, etc. because they can’t produce the paperwork that showed they lost their job. There’s somewhere around that type of fraud in the entire system. With all the stimulus stuff is why Michael Becker’s cowboy Math is here. That’s how much waste is out there. I know you said Richard Duncan doesn’t believe there’s going to be inflation and he thinks rates are going to be low. I concur that I think rates are going to be low. There’s so much excess liquidity on the system that is going to drive it down.

On the short end of the curve, you’re floating adjustable-rate mortgages. Your two-year treasury rates will stay low for a while. We’ve seen a little pressure on the ten-year treasury, but I don’t think that’s going to go very far either. I think we’re range-bound somewhere around where we are for a period of time. If it starts going, the Fed will start doing yield curve control and start buying the long into the bonds and then keep it from going. I do believe there is inflation. They mask it with having a flawed calculation. If they would calculate CPA as they did many years ago, we would see a lot of inflation because you look at all the input costs to all the real things of the world, the oil, lumber and you try to get an appliance package.

They’re doubled in the last several years to get the same basic appliance. All these input costs are going up. I can promise you looking at my portfolio with 95% occupancy, all this back rent about to get paid, all these people moving here, and the input costs to build a new multifamily product going up. We’re raising our rents. We see in the markets I play in. We had a flat year. Austin was negative 2%, Dallas is positive 1%, and rental rate growth, as a market as a whole in 2020, in spite of everything, it’s relatively tamed. It was flat. We see 5% to 6% rent growth in 2021. Real-time when I’m trading out my old leases, my new leases, that’s what we’re seeing and we need to because these places are full.

We’re able to push rents. That’s what I’m seeing. I believe there’s inflation out there in the things that matter, like housing, and buying a car or trying to drive a new one with oil. There’s real inflation there. I don’t see what’s going to stop it. Seeing the pricing of these things feels like we wrap it up in the first quarter of 2021. It feels like prices moved $20,000 a unit citywide, both in Austin and Dallas, because there’s so much capital coming here. It’s insatiable the amount of demand because all these people that were previously investing in the coastal markets are starting to look in the center of the country and Arizona, Florida, Texas, Georgia, the Carolinas, those are on the end market.

California, New York and Seattle are on the out markets. That money is coming here and a lot of money is rotating out. If you want to make commercial real estate, it’s hard to invest in hospitality, retail or even office. They’re rotating out of those sectors more into industrial and multifamily. There’s more money chasing it. At the same time, they printed 25% or so of the money circulation was generated in the several months or something like that. This is all money sloshing around and it’s going into risk assets like commercial real estate. It’s disproportionately going to multifamily. We’re seeing prices accelerate.

You have the dynamic of when somebody moves from California, first off, tax savings. Second, they’re going from $3,500 to $2,000 a month for an apartment or maybe less. You have the built-in flexibility where raising rents by 5% to 6% will be a no-brainer for most.

Multifamily Real Estate: Rates are going to be low. There’s so much excess liquidity on the system that is going to drive it down.

That’s what we’re seeing. I’m still bullish on Texas multifamily. We have done well. One of the things is talking to investors that have been with us for a while. Leading up to the COVID lockdowns, people would talk to me about what happened in the prior decade, the teams basically. What seemed to me was in the Dallas-Fort Worth, in the workforce housing space, in particular, rents much doubled in the last many years. The price has tripled because the rent has doubled and then the cap rates compress. It’s the combination of those two things. This hasn’t stopped. We went on hibernation for about three months, got right back at it and prices didn’t move at all.

If you had the ability and the guts to buy something in that 2 or 3-month period in April or May 2020, maybe you got a 3% to 5% discount if you bought it in that two-month period, and someone was willing to sell. Most everyone else took their ball, went home for a few months, and put the head back up and things were okay in the multifamily space, at least. Most people that come to us, your second party question was, we get a diverse investor base. Mostly high net worth people from various industries, either they have a good income, make over six figures, accumulate some money and want to get a return. We have some business owners, doctors, a lot of people that pay high-income taxes, especially in the coastal markets where you not only pay the Federal Income Tax.

You pay California, not only Uncle Sam, but Uncle Gab out in California. They come to multifamily space and they get some good tax savings with the depreciation, the law, the way it’s written at is favorable for the multifamily industry. We see quite a bit of that. Business owners, you see a lot of people that even have bought some commercial real estate that appreciated, and they want to stay into space. It was a diverse mix of people. We would finish up our tax returns not too long ago. We did $1,300 and $50,000 ones for the 2020 tax year. We have 700 or so unique investors that invested with us. We are growing by the day seemingly. It’s been a good business and bullish on multifamily in Texas.

I don’t see what is going to stop that. Immigration wasn’t going to stop the price appreciation because rents are going to grow. Was fuel ever going up? I don’t see how it let interest rates rise to any material respect. If they do let it rise, it’s going to make single-family housing, even that much more expensive to own, which will then further drive rental rates up. All things being equal. There’s a world full of bad options from an investment standpoint. If you want to get some yield, you’ve got to take some level of risk and there’s no rule. You can’t go get a 5%, one-year CD as you could have many years ago. If you want yield, you got to put risks either in the stock market or some investment as I do or various other things out there. All things being equal among the better asset classes out there, which is why I dedicated my career to it.

Michael, thanks for your time. Thanks for sharing your expertise. What’s the best way readers can follow you to learn more about multifamily investing?

I appreciate you having me on. Hopefully, we see each other for the next cruise sometime. The best way is to go to a company’s website, which is www.SPIAdvisory.com. There’s a Contact Us form. You fill that out. We’ll happy to send out information about what would we do and potentially working with us.

What a crazy time to be an investor. At the same time, there are lots of opportunities out there if you know what you’re looking for.

Important links:

- http://www.SPIAdvisory.com/

- Contact Us

- Old Capital Real Estate Investing Podcast

- MultifamilyInvestingShow.com

- Ken McElroy – Past Episode

- Richard Duncan – Past Episode

- https://www.Linkedin.com/in/Michael-Becker-SPIAdvisory

About Michael Becker

Michael Becker is a Principal at SPI Advisory LLC and heads SPI’s Dallas, Texas office where he oversees all aspects of property operations, including asset management, property management oversight, accounting and taxation, capital improvement and renovation projects and investor relations. Michael is a lifelong resident of North Texas and a graduate of The University of North Texas with a BBA in Finance. He is married and has two young children.

Michael is a 15 year veteran Commercial Real Estate Banker and has originated and managed numerous portfolios of permanent and bridge loans in all major asset classes. Over the last 5 years of his banking tenure, Michael focused exclusively on multi-family properties, where he was the number one loan producer for his division at a Top 3 National lender for his last 3 consecutive years.

As a Portfolio Manager, Michael directly oversaw the management and financial performance of the countless C & B class Multi-Family properties he originated loans for. As a result, he accumulated an exceedingly diverse network of suppliers, contractors, consultants and service providers during his tenure. This gives him the ability to quickly and efficiently implement a breadth of value-added strategies for a fraction of the typical cost.

Love the show? Subscribe, rate, review, and share!