Quantum Computing, Quantum Leap Technology, AI, And More From The Finance Summit, Part 2

Podcast: Play in new window | Download

In this second installment, Patrick Donohoe wraps up Tony Robbins’ Finance Summit events and shares the learnings he unlocked from it. Discussing China’s indifference about the trade disruption, he also touches on quantum computing and how diversification across different non-related assets is essential. He also breaks down Tony’s six-step decision making process and Greg Wieler’s four forces that tells the future, and recaps on Eric Prince’s segment. Find out more about quantum leap technology, artificial intelligence, and more in this information-driven episode.

—

Watch the episode here:

Listen to the podcast here:

Quantum Computing, Quantum Leap Technology, AI, And More From The Finance Summit, Part 2

Ray Dalio Talks About China

Thank you for reading this review of Day 3 of my experience at the Tony Robbins Platinum Partnership Finance event up here in Sun Valley, Idaho. This was by far the most packed with information. I’m going to try to keep it brief, but I learned quite a bit. There was some interesting insertion or inserting of information that I wasn’t expecting and I had heard it before, but it made an even bigger impact for me. I’m going to share that. There were some speakers who went back to back that had polar opposite views in a sense of where things were going. It was fascinating to see that dynamic and how much that not only inspired my new level of thinking, but the audience as well. Let’s get into it. The first speaker right out of the gate was Ray Dalio. He was about a good friend of Tony’s and has become successful. He wrote a book called Principles, which I’ve referenced often. There were some great nuggets in there in regards to investing business and life in general. Check that out. Ray’s message wasn’t necessarily something that was outside of the video I’ve already mentioned, which is how the economic machine works.

Here are a few things that I took away. First, he made essentially a statement around where we’re at in the debt cycle. That relates to his video that I’ve referenced a few times. He said that we’re late in the short-term debt cycle and even later in the long-term debt cycle, but not quite to the point where there are a correction and disruption. I would say it’s a QE4 in a sense, which is the Fed’s involvement in the repo market. This has to do with bank liquidity and banks have to keep a certain amount of reserves. If they don’t have those reserves, they usually will borrow it from other banks. Over the last few months or so, that liquidity has shrunk and so the Fed has gotten involved. The Fed is providing this stimulus. It’s lending against high-value assets of a bank and injecting even more liquidity into the market. It’s interesting how they’ve done that, but it isn’t necessarily manifesting in inflation and huge amounts of growth. That’s because the inflation is in the financial assets, not necessarily in goods and services. That was an interesting insight.

He made a point about China going to another topic. He said that China doesn’t care about the trade disruption that they’ve had with regards to the Trump administration. He said that’s not necessarily a big concern for them. Their biggest priority and biggest concern is technology. They believe that the leader in technology is the one that’s going to essentially control economies, the global economy. That’s where China has been focused. Also, the dilemma is that the US and China are intertwined in regards to its technology. As far as the demand, I would say there’s a huge demand for the different technologies that the US has that’s all manufactured in China, which is interesting. Also, he made mention of quantum computing. Quantum computing is one of those races that companies are similar to 5G.

Google has made some strides toward having economical quantum computing. China is ahead of the game, ahead of any company in the United States, which I thought was interesting. It’s going to come down to the power needed to have these quantum computers run, which is an exorbitant amount of power. I would say part of the race is figuring out how to make that economical. The last thing I’ll mention is the idea that China is trying to disrupt the global economy and take over leadership and that’s going to be based on its control over technology. That’s one of the things that Ray had mentioned.

The next thing was the idea of tactical investment. He said that tactical investment, technical investment trading, ride short positions and ride long positions. It’s one of the most difficult games that’s out there. He said that the average investor has way more to gain by diversification. In Tony’s book, MONEY Master the Game. One of the takeaways from his interview with Ray and what Tony had Ray help him with is the creation of a portfolio that’s called The All Weather Portfolio, which is a combination of different assets. There are bonds, gold and commodities in there. What those assets are is when one goes up, the other goes down and there are about 5 or 6 types of asset classes in that portfolio, whereas things fluctuate in the global economy, then it’s able to counterbalance in a sense. I’ve backtested that. I’ve created a whole spreadsheet with a guy on my team. We backtested for 50 years and it does work. The gross yield was around 8% and you have to net out fees. That’s an internal return, which is interesting. He not only mentioned that but also to diversify into other asset classes. He said that the ideal diversification is across at least fifteen different non-correlated assets.

The last thing he mentioned is that there’s going to continue to be more stimulus. We’re seeing in the repo markets at the same time there’s still a tiny bit of room, but he believes that there’s going to be continual printing, especially this year being an election year and then the wealth gap. He mentioned that this is one of the biggest concerns. It’s where he is putting a lot of his philanthropic focus is into this wealth gap. At this time, 40% of the United States can’t come up with $400, which is concerning. If you look at Andrew Yang pushing universal basic income and also Bernie Sanders and his message, which is anti-establishment, but socialistic is attracting the lower tail of our socio-economy. It’s concerning to him because that gap continues to broaden. It comes down to the financial asset inflation, where that is made individuals wealthy at the top, but it has not helped those that are at the bottom. Ray wrote an article on LinkedIn about universal basic income and his study.

Growth takes place in environments that challenge you not just physically, but mentally as well. Click To TweetTony’s 6-Step Decision Making Process

The next thing, not necessarily an intervention, but there was a woman who stood up and was talking about her investments, what she was taking away and what she was trying to determine as far as some of her next steps in business. Tony did something and I’ve heard this before, I’ve come across it, but he went into way more detail and something hit home to me. I’ve been talking this a lot over the last several podcasts, which is this idea of where your focus is when it comes to your future and the decisions that you make. He has a six-step decision-making process.

I looked online and there are several resources available. There’s a Fortune Magazine article that discusses it in detail. It’s the OOC/EMR. The OOC is step-by-step. The first three steps being, how to start to identify the basis of your decisions. These are all acronyms of course. It’s Outcome, Options and Consequences. The outcome is first, which is getting crystal clear of the outcome you want. What are the results that you’re after? Getting clarity, crystal clear of exactly what those outcomes, those results are. I’ll go through some of the notes that I took. What is the result you’re after? Why do you want to achieve it? Getting clear about outcomes and their order of importance, you start listing out and it’s a brain dump in a sense. That’s what he was having this woman do. Options, write down all of your options, whatever comes to mind. He says that one option is not a choice.

Two options are a dilemma and three options are where you do have a choice. It’s coming up with as many of those options as possible. He also said that it should include the maybe farfetched type of options. Options that you may think is crazy but listing all of them out and there’s a whole process to this once you’ve done it. Outcomes, all of your different options and the consequences are the next one. What are the upsides? Consequences are positive and negative consequences. What’re the upsides and what are the downsides of each option? What do you gain by each option and what would it cost you? It’s answering those questions as it relates to all of your options.

Finally, it’s evaluate. Now, you go back and you evaluate all the options and the consequences and if it does get you what you want as an outcome. Start to rank those in order of importance based on the upsides and downsides. The next one is the probability. What is the probability that it will happen, that this option will work? What that does is it gives you an idea of what is the specific direction as it relates to the decisions you’re going to make. Finally, it’s mitigate. As you review the downsides of all, you brainstorm alternative ways to eliminate or reduce the downsides, which is important because as you can review, if I have a downside, you list the downside, but, how can I get rid of the downside? How can I mitigate the risk of a downside?

Finally, it’s resolving. It’s going back through and selecting the best option based on ways in which you’ve been able to rank and categorize them. It was fascinating and this was probably, I would say at least an hour-long type of discussion with this woman in front of everybody. She had multiple breakthroughs being, she got to this point where it’s like, “I can do this.” You can see her as her mind starting to expand. It’s that whole quote of, “Mind that got you to where you are is not the mind that’s going to get you beyond.” It’s opening up that mind breaking through thresholds in being able to figure out, “What is a decision I can make that it will get me closer to the results that I’m after?” That was fascinating. I love that.

It was two speakers that were again the polar opposites. The polarity that existed between their perspectives of the world was fascinating, especially they were back-to-back. Tony did this by design. The first is Harry Dent. He has spoken at Tony’s conferences for a long time and he does it because Harry Dent has some track record issues. There are a lot of calls that he’s made in his books that has not come to fruition or were early or were late. It’s happened for several decades. Harry took a stand with Dent Research, which is a part of the Agora Network where he started writing newsletters. It wasn’t these books that he would come out with and then write about how the future looks like this.

Tony Robbins Finance Summit: China is trying to disrupt the global economy and take over leadership which is based on its control over technology.

Where he’s writing through a newsletter, a publishing business would allow more accuracy. He’d be able to course-correct quicker, which is smart. Regardless, this is what Harry said regarding the future. He said, “There is going to be a downturn.” Harry has written often about demographics and the spending of demographics, their net worth and where their asset concentrations are. He said that we’re either at or beyond the peak of Baby Boomer spending. The Baby Boomers started in 1946 going to 1964. That’s the years in which the Baby Boomer demographic was born. We’re getting to that almost 60 years old where it’s the end to the Baby Boomers and their spending peak after they’re empty nesters. Their parents are finally free. That’s when they start to spend a lot of money. That’s what’s going on. That’s going to come to a close soon.

He said that plus the behavior of youth and I’ve talked about the greatest wealth transfer in history, which is a set to come in the next years amounting to tens of trillions of dollars. It’s going to be different buying behavior of this younger demographic, different assets that are also in a different financial situation, whether it’s the debt that they have or the professions that they have. It’ll be interesting to see where money flows once this wealth transfer starts to take place. He said that being in cash is a good thing. You’ll be able to take advantage of opportunities. He sees major disruption in 2022 and Dent Research has multiple newsletters. They have a free newsletter as well if you guys want to follow them.

Finally, he mentioned that a lot of the opportunity from an investment standpoint is in healthcare, specifically care to those that are aging, whether that’s nursing homes or assisted living. There are tons of private investments out there, but there’s a lot of public investment out there as well. Several ETFs or REITs, Real Estate Investment Trusts, that concentrate and focus on essentially different types of housing and real estate for an aging demographic. That was Harry. He is an entertaining speaker. He is somewhat crude in moments but at the same time, he was entertaining. One of my buddies, Matt Atkinson, I need to get Matt here one of these days. He has a distinct laugh. He was sitting probably toward the back from where I was sitting. You can hear his distinct laugh several times throughout Harry’s comments.

Let’s talk about Peter Diamandis. Here’s what’s cool. Peter essentially said at the end that all of his slides, which I already have can be made available to anybody. We can share those. I’m going to post a link for you to download those slides. Make sure you go to TheWealthStandard.com and there’ll be a link there to download. He is a thinker and I’m not going to spend a ton of time going into my notes there. I first read Peter’s book Abundance. He has Abundance and then Bold. He has a new book. It’s called The Future is Faster Than You Think.

I read Peter’s Abundance book it was about 2009, 2010 where it was a dark time for a lot of people, including myself. There were pessimistic views as far as what was happening within markets. Peter wrote a book about essentially how incredible the times were that things were much better in the past. There was much innovation going on. That the world was getting better and he had all proof of how it was getting better. I love that mindset because he knows what’s going on. He knows that there’s pessimism, but one of the quotes he used was that, “A negative mind will never give you a positive life,” which I love because it’s always been that way and always will be that way. There’s always going to be a half-empty glass.

Peter And His Ideas Of Growth

I know if the focus is there, that’s where your emotions and your feelings are going to focus and regardless of the circumstances. In 2010, those dark times was an amazing time if that’s the mindset that you had. There were tons of opportunities, whether it was real estate or other types of business investment. Since then, it’s been this huge boom. I love how Peter thinks, but the polarity between a pessimistic view of things and then an optimistic view of things was healthy. It helped broaden not just my perspective, but a lot of those that were in the room. A few of the things that Peter mentioned, you will be able to get into the slides and dig into some of the amazing innovation that’s going on.

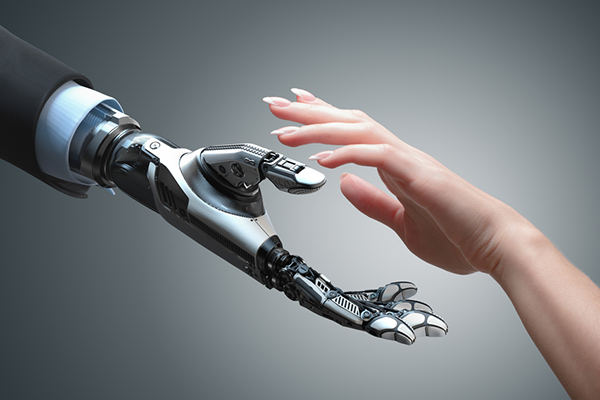

Concentration, understanding the future, and energy information are going to create better lives for everybody. Click To TweetWe are in this exponentially growing a society where it was Moore’s Law before. It’s the acceleration of acceleration. It’s this quantum type of leap toward the future. That’s what growth is like. Also, it provides a lot of opportunities because he cited some polls of the simple question, is the world getting better? Six percent of the US believes that it is and 94% don’t think that the world is getting better. He had all statistics on poverty being cut in half in the last decade. Child mortality and famine were going down. Half the world is using the internet. There are almost 800 million more people in the last decade that have electricity and renewable energy. There’s ten times more solar power than there was and then he gets into the future. The future of being driven by artificial intelligence and biotech.

He said that the concentration as far as understanding where the future is going is an energy information and material. The combination of which is going to create better lives for everybody, but also an extreme amount of wealth for those that know how to ride those waves. He mentioned personalized drugs. CRISPR, which I’ve known about for a long time, is a way in which a map is created for the human genome being able to have different ways in which you can edit and improve genetic disorders. It’s fascinating and some of this might be scary as well. I know most of something you were thinking that a lot of the crowd, that’s a way in which they responded.

Tony invested in a 3D printing home building company in Mexico. He has two printers but they’re able to build 2 or 3 homes a day and they’re $10,000 each. He’s talking about rockets and how SpaceX and other companies are being able to capitalize on either putting satellites in that provides a 5G type of internet globally. Digitizing of factories, which is going to bring costs down, but also it’s going to decrease dependence on foreign manufacturing. We’re seeing that with the coronavirus and how that’s disrupted the supply chain. I don’t think we are yet to see the impact of that. Some are saying that it could be an impact last longer than a year in disruption of the supply chain. 3D printing is going to essentially help us to create factories on site where you can 3D print parts as opposed to having to manufacture in shipping costs. The use of fuel and energy for that shipping and so forth. He talked about flying cars that there’ll be Uber Copter in Dallas. He also spoke about Kobe Bryant’s helicopter going down. The older style of helicopter makes that type of flying dangerous, but the more modern ways in which Bell and other companies are creating copters with multiple blades, multiple propellers, which highly mitigate the probability of crashing.

He said that by 2021, Elon Musk thinks that there’s going to be fully autonomous flying vehicles that can be commercialized. Boston Dynamics, he posts a video about this jumping robot that Boston Dynamics has created. It’s amazing what it’s able to do. It’s a matter of bringing down costs. Next is artificial intelligence. It is going to make decision making much more accurate and the reduction of error and the reduction of time and energy spent on making decisions. Information will be provided based on trends and patterns. There’s a guy that spoke about how he’s created an unlicensed 5G network where you could put up a tower anywhere if you own real estate. If you have a building, you put up a 5G tower and it can circumnavigate buildings and so forth and create a beam of the internet at 5G quality for $6,000. for each tower and it can give access to over 500 households. He says that if you network 30 towers, you can essentially provide 5G to an entire city. We don’t know what the impact is going to be of these different frequencies and how that’ll impact the body.

Based on this guy’s innovation, it’ll highly reduce the number of towers, even reduce the number of towers that exist to provide that type of internet at those speeds. OneWeb is that satellite company and I can’t remember the name of the 5G company. He talked about quantum computing as well. It’s human longevity and what we’re being able to do there. It’s fascinating. Peter has Abundance 360 with his conference. He also has what’s called the XPRIZE. It’s essentially putting a prize out there to whoever wants to tackle that. Whoever does get some of the prices are $10 million. He has a $100 million prize.

Event Wrap Up

I’m going to wrap up this amazing event. I’ve been on the road. I’m ready to go home, but it’s been life-changing. These are environments where your mind is almost forced to expand both with what you’re being taught by the speakers and guests, as well as all the conversation that takes place afterwards. There are a lot of high-level people here. It’s been amazing. I’m still processing everything. Day 4 was no exception. Every single day has been packed full of amazing content, amazing people and ideas. They make you think differently. Those are environments that serve everyone. I don’t believe growth takes place in passive environments, environments that you’re used to. Growth takes place in environments that challenge you not just physically, but mentally as well. I’m going to go through a few of the speakers and wrap this thing up. We started around noon every day because most people would ski and so forth in the morning.

Tony Robbins Finance Summit: Artificial intelligence will make decision making so much more accurate with a huge reduction of error.

We opened Day 4 with Paul Tudor Jones. This is a guy that Tony Robbins has coached for decades and is one of the most successful traders out there. For those of you who have not heard of him, he Founded Robin Hood, which is a platform that has raised billions of dollars under the banner of low fees, automation and so forth. He’s been successful with those entrepreneurial ventures but also trading as well. I want to set some context of his remarks because he was at the airport on his way to the Federal Reserve. He was on their advisory board and/or the advisory board was going to be hearing from him. He had prepared some words and some statements for them. That was his mindset. It’s interesting.

Some of the things he said are the managing or governing member of this specific panel that he was going to talk to wants higher inflation. He wants growth. What Paul was saying we’re in unprecedented times because we have the lowest interest rates in history. We have the lowest unemployment almost in history, but we have the highest budget deficits and it’s difficult to cut. Erik Prince of Blackwater said that “The US needs to go on a diet.” We need to experience scarcity to expose the waste and get rid of the waste. Paul said that the majority of the US budget is fixed. There is no discretion as far as cutting here or cutting there. He said, “78% of the US budget is fixed.” Whether that’s interest on the debt or whether that’s your unfunded liabilities, your social benefits, Medicaid or Social Security.

He said that an economy that has the lowest unemployment, lowest interest rates should be running budget surpluses, but we’re running budget deficits. It means that we’re spending as a country $1 trillion more than we bring in an all tax revenue, which is insane. That’s his mindset. He’s always looking for opportunities. He’s going to the Fed to speak his mind. He’s there to give them feedback. He’s there to give them information. He’s not going to be able to go in there and change their mind, because a lot of influential people speak to them. He goes in there with challenging their thoughts. This was a great way to do it, saying, “We are in these unprecedented times. You want all this growth, yet you’re printing your way to growth.”

He also alluded to financial asset inflation. You’re getting growth, but they’re not getting growth in the areas that they want it. That’s mainly due to those that are using low-interest rates. It’s mainly businesses and institutions. They’re not using it for productive purposes. They’re not using it to hire more people. They’re using it to push up their stock value and so forth. That’s one example. A few of the other things that he said is when he’s making investment decisions. His decision is based on a 5:1 ratio. He loses a lot. Tony has referred to this before, where Paul Tudor Jones would send him trades every day from an accountability standpoint. A lot of the times he was losing, half the time he’s losing. When he wins, he’s shooting for a 5:1 win and that 5:1 makes up for all of those losses and some. It’s an interesting way of looking at it. He also alluded to the markets. He was referring specifically to the S&P was at a 22 Price to Earnings Ratio, PE ratio. If you go back to some of the ratios that were pre-2008, pre-2001 with the dot-com crash, we were at 27:1, so there’s still some room to go.

He also made it seem that between now and the end of the elections, he also alluded to the markets being priced for a Trump win, but there’s not going to be much volatility. If anything, there’s going to be growth and there’s room to grow as well. There’s also room for more stimulus. I mentioned with regards to QE4, which is the repo markets and the fed being able to provide additional liquidity by injecting liquidity with collateral being these highly valued assets like treasuries and so forth. He said that we’re in the time where you can compare it to Arnold Schwarzenegger’s movie Pumping Iron where he was hugely jacked and boosting all these weights and veins popping everywhere. It was all based on him in steroids and doing it artificially. That’s what he said. He made the statement at the end that made everybody laugh, which is, “These are the best two hours of your life.” It’s 11:00 PM or 10:00 PM, the last hours of the day. “It’s going to be the greatest two hours.” He eluded to whether it’s drinking or partying, but you’re going to have a massive hangover once that happens, alluding to the economy as a whole.

He also got into where things are going. The demand has enhanced where he’s seeing more socially and environmentally conscious investors. He also created a fund that is backed by Goldman Sachs called JUST Capital. It’s a fund where there is a specific set of criteria for all the different companies that are within this fund there are socially environmentally conscious as well as have a more even keel distribution of resources than fiduciary responsibility to shareholders. He was alluding to taking care of employees, paying above-market wages, also being charitably conscious and forth. It’s interesting and fun. Paul Tudor Jones was a great speaker.

If you're looking to construct the way in which you invest based on the last 20 to 30 years, that is a losing strategy. Click To TweetGreig Weiler And The Four Fources

I’ll get into some stuff that’s a little bit more exciting. Two more speakers and then we’re done. The first was fascinating. This guy had much energy and he was one of those resourceful people and his history has shown it. His name is Greg Wyler. He runs OneWeb, which is 5G-based. It’s more of a satellite system and Tarana. It is the biggest competitor to Comcast to broadband. His background is he laid the majority of fiber in Africa and he has deep, intimate knowledge of that country and what’s going on there. I’ve alluded to more youth in Africa than double the population of the United States. Africa is booming. It’s crazy. There’s a lot of youth. These are people under the age of twenty amounting to hundreds of millions and they know what’s going on in the other parts of the world. Once they’re connected, it gives them huge opportunities.

He’s started laying fiber in Africa, networking and connecting schools. He has a platform where you can go check out the connectivity of schools in Africa. It’s called ProjectConnect.world. He said that the youth are waiting for this. He also realized that by experiencing laying fiber throughout the country, the internet that way is not going to work. That’s where he started to get into the satellite business. He’s been there for several decades. OneWeb is one of the companies he’s running. It purchased rights for a particular frequency in space. This is outside of my realm of understanding, but that frequency is almost exclusively owned by them. He has some of the more modern satellites that can move and navigate. He said that it’s getting busy up in space and satellites are getting more dangerous because they can start to collide. That’s not good for any satellite system.

His company, OneWeb has figured out some techniques to mitigate those risks. Those risks exist for a lot of other companies that are putting satellites into space for this purpose. Tarana is this first broadband company to compete with Comcast. It’s a $6,000 a unit. You can attach it to a building and it provides a unique way of 5G connectivity. One gig up, one gig down and it’s extremely low-cost. He said that $1 million in infrastructure costs. $1 million could create 1G up and down for the entire city of Sacramento. If it’s $1 million in costs, it’s amazing. That’s where things are going.

He also alluded to this is a huge opportunity because 20 million people in the United States do not have good internet, if any internet, which is surprising. It’s a huge opportunity there. Greg was a great guest. You can tell he’s super socially conscious and entrepreneurial. The money he raised for OneWeb or one of the first satellite companies he had was $1.5 billion. There was no proof any of it was going to work, but he hustled, grinded and figured out a way to make it happen. I’m following him. He’s a go-getter but also is doing a lot of good in different parts of the world, mainly the emerging markets. The last individual I’ll talk about is Michael Smorch and he has worked with lots of different VCs and hedge funds and has been around the block. I enjoyed some of his thoughts. He said that if you’re looking to construct the way in which you invest based in the last several years, it is a losing strategy. He said everything is exponentially growing and emerging. A lot of opportunities are no longer in the US. The opportunity is in emerging markets.

He said that four forces will tell the future. First is there’s going to be geopolitical alignment and he alluded to China. All of these speakers have alluded to China, with the coronavirus, it’s going to be interesting to see how that creates disruption, but at the same time, because of that huge dependence on China, other opportunities are emerging because of this. This is the nature of capitalism and entrepreneurs and it mainly had to do with bringing the supply chain closer to the actual end-user, which is 3D printing. He alluded to 3D printing. The first is the geopolitical alignment. He said that China-based on its influence controls the majority of patents for 4G and it’s controlled by Huawei. There’s this continual alignment of these two big forces, China and America. It’d be interesting to see how that comes to fruition.

The next one is the digital revolution. It’s no longer Moore’s Law, which is the doubling of computing power. It’s Neven’s Law. It’s the acceleration of acceleration. He also alluded to that. He said that AI is coming online in many different areas. We use it in our database but AI is essentially creating the ease of some of the backend work in order to make better decisions. It’s coming in everything. Insurance, investment, school, on our device, the wearables and being able to have the information so that we know, “Eat this, stand up, do some exercise.” It is getting more and more accurate to help us live better lives, to help us to use our energy to make meaningful decisions as opposed to the stuff we have to spend our energy on, which can be eliminated. The third force is Millennials. He alluded to different studies that showed that Millennials pretty much hate all of their parents’ assets.

Tony Robbins Finance Summit: Tony Robbins’ events can impact your ability to create wealth.

They hate gold, they hate the market or they want different advice, more robo advising cheaper funds as opposed to speaking to financial advisors. There was also a study that if they had an extra $1,000 in discretionary money, what would they buy? It was over 40% who would buy Bitcoin and all the other options were like a mutual fund, cash or gold. It’s a different demographic. Also, he alluded to their peak in spending is coming within the next couple of years. To give some context to that, some reference to that, if you look at the Baby Boomer peak of spending, that was in the early ‘80s. If you look at the boom and the economy in the ’80s and ’90s, these were the greatest growth years in pretty much in history. He said that’s coming soon in the next couple of years for Millennials.

The third force is the environmental change. This is interesting. I hadn’t thought about this before, but he used a great example. He said that there is global warming. One of his biggest clients is a dynasty family in Italy who has massive wineries and they can’t grow. It’s too dry in Italy and they can’t grow like they used to. They picked up a massive plot of farming land in Patagonia. He said that those that are growing are going North and also going South toward each of the poles because things are warming up. Those are the four forces. It’s geopolitical alignment, the digital revolution, Millennials and environmental change. It came down to the Holy Grail. The Holy Grail is his way of getting these asymmetric types of returns. The companies or the industries, the environments that are going to have this asymmetric growth have a growth story behind it. There has to be a massive market. The audience that would take advantage of whatever the sector was had to be massive. It also is something that hardly anyone owns, especially institutions. They’re not there yet, but it captures the heart and minds of people. It’s movement-based.

Finally, it creates forced buying, like Comcast. If you want a good internet, you only have 1 or 2 options. It’s a forced buying situation. The example he gave is number one, space, whether it’s SpaceX. There’s also an ETF that owns a lot of these space types of companies, which has a ticker symbol of UFO of all things. This is an environment where whether it’s the satellite idea. There’s a guy I met that has a company that does transportation in space, both from satellites to the space station. There’s a huge environment, whether it’s mining asteroids. There are tons of opportunities there. That’s one example. With our new military force, space force, which I could do a Donald Trump impersonation of, but I can’t. That’s another example of where things are going.

The last one is Biotech. That was another example he gave of this Holy Grail of asymmetric type of opportunities. It’s a growth story, a massive market, something hardly anybody owns already, especially institutions. It captures the hearts and minds of people and it also creates force buying. He said biotech was one of those other things where we do a lot to respond to getting sick or pain. Biotech is getting to the preventative. We know in advance what needs to be done in order to avoid that. Those are a couple of examples. This was a great couple of days for me. Hopefully, you got a lot out of my thoughts on what I learned. I encourage you to take the opportunity to come to one of these Tony Robbins events, the basic one. Come to the UPW if you haven’t been.

This is an environment that pushes you outside of your comfort levels. It’s an environment that forces you to grow. There’s much on the other side of this environment that will help you with your relationships with business. It’ll facilitate an even more meaningful life. I know that’s what everyone’s after, especially myself. I hope you guys take advantage of this opportunity. If you call my guy, Jeff, over at Tony Robbins, he’ll hook you up. It’s a little bit too late maybe for the March event, but Chicago is in the summer and then New York City is in the late fall. Hopefully, you were able to take advantage of it because I know it will impact your ability to create wealth. It’ll impact your ability to take your life, your business, your family, your relationships to the next level. I can’t wait to hear your feedback and stories about it. Thanks again and we’ll catch you next time.

Important Links:

- Tony Robbins Platinum Partnership Finance

- Ray Dalio

- Principles

- MONEY Master the Game

- Harry Dent

- Dent Research

- Abundance 360

- XPRIZE

- Robin Hood

- Peter Diamandis

- Abundance

- Bold

- The Future is Faster Than You Think

- OneWeb

- Paul Tudor Jones

- JUST Capital

- Tarana

- ProjectConnect.org

- Michael Smorch

- Download Diamandis MetaTrends

Love the show? Subscribe, rate, review, and share!